We had a terrific year. This is not only because of our outsized return. I am very satisfied because we outperformed both metrics that I measure Talguard against which is the Barclay Hedge Fund Index and secondarily against the S&P 500 With Dividends Index.

In the long run, I am ever confident in America’s prospects. Our children will live better than us. Relative to current interest rates valuations are not overly heated. However, if interest rates rise they are like gravity to asset valuations. For the past 40 years, interest rates have had a long term downward trajectory. The current interest rate gravity environment is so low it’s like an astronaut living on the Moon. Eventually that astronaut will come back to Earth and it will be difficult to adjust to the heavier gravity. That is the situation we are in with stocks and interest rates. I fully expect our strategy to outperform and really shine when a downturn comes.

Talguard’s Year:

Many of my ideas have proven correct and we substantially grew the value of our assets. The Market may go up or down but I fully expect the earning power of the companies in our portfolio to compound every year. Some volatility has returned to the Market in recent weeks. You will be happy to know our investments continue to perform well. The recent rumblings are potentially tremors for larger volatility at some point in the future. There are several market distortions that are affecting the bigger picture: stimulation from Central Banks and recent government policies resulting in interest rates that are artificially low, the rise of passive investment funds, the rise of leveraged investment funds, and the amount of worldwide leverage on a personal level and government level.

These factors will create outstanding opportunities for us when they arise. In the meantime, we continue to stay invested in the fantastic businesses that we own for our current capital. I treat investing in stocks as ownership interests in businesses, not as a pieces of paper with prices that go up and down.

Talguard’s Strategy and Objective:

Talguard Value Fund LP is a private investment fund that seeks to deliver superior returns by investing in the equities of companies with durable competitive advantages purchased with a margin of safety. The goal is to beat the S&P 500 Index and the Barclay Hedge Fund Index over the long run.

I am looking for a very specific type of company for investment. These companies are often #1 in their niches, many years of consistent and growing cash flow, and certain other attributes. Most importantly, these companies often have multiyear catalysts that will generate value over time. Once identified, I will seek a discount to intrinsic value prior to investing. However, I rather invest in great companies at fair valuations instead of fair companies at great valuations. I seek are often multiyear compounders.

Our portfolio consists of two groups of investments. The first group I call “Core” companies that will often stay in our portfolio for the long run. These are great companies that I invest in either at discounts or at reasonable valuations. For these Companies, holdings can be lowered when valuations are too high and they can be added on when prices take a dip.

The second group of investments that we hold is what I call “Opportunity” companies. These are companies with many of the attributes as Core Companies but could be a step below. The Market usually has discounted these companies heavily either because of a short term weak earnings quarter or several quarters, an idiosyncratic sector selloff, or other very specific reason. I like to invest with a discount to intrinsic value here but I am also patient. Patience can result in Opportunity company stocks providing a larger discount to intrinsic value.

As an emerging fund, we have a distinct advantage over large funds. We can be nimble while they often have to follow esoteric rules. Just because a well known fund is larger does not mean it performs better. In fact, a variety of studies have shown that emerging funds have often outperformed these larger funds. The most significant example is a comprehensive study produced by Nick Motson, Andrew Clare, and Dirk Nitzche, three finance professors at the City University London. They surveyed 7,261 funds for 20 years from January 1995 to December 2014. They found that the largest 10% of funds returned an average of 7.32% a year for a total of 410.8% return over those 20 years. The smallest 10% of funds returned an average of 9.00% a year for a total of 560.4%. A $1 million investment in the largest funds category results in a balance of $4.1 million while the same investment in the smallest funds category results in a balance of $5.6 million. Of course, past performance is no guarantee of future results but the historical evidence is there.

A number of high profile large funds not only continue to underperform the Market over multiple years, but they have negative returns while the Market has enjoyed a near decade bull run. Larger funds do not necessarily translate to better results.

My strategy has an additional advantage that many emerging funds do not possess. Talguard has invested primarily in large cap and mid cap companies which mean our strategy is highly scalable. Many emerging funds are focused on small cap and micro cap companies. They cannot take on too much more capital investing the same small companies because the float on those shares is much smaller. They would alter the Market for those shares.

|

| Health Care, Biotech, and Pharmaceuticals companies are providing very real benefits and services to their end users and to society. |

Health Care, Biotech, and Pharmaceuticals:

One investment we own in this sector has vastly outperformed the Market in both appreciation and dividend yield. It is a classic case of the Market overreacting to a lower guidance and geopolitical headwinds. This stock is a quality Talguard type of stock.

The recent announcement from Berkshire Hathaway, Amazon, and Microsoft that they will collaborate on making health care cheaper makes sound business sense. However, I do not see that as an existential threat to the current U.S. Health Care Industry’s current business model. It will likely take some form of government push and oversight for health care product and service prices to stay in line with inflation over the long run.

I admire the people working in the Health Care Industry and those who took the Hippocratic Oath to uphold ethical standards and to genuinely want to heal and help people. However, several aspects of the U.S. Health Care Industry have a fundamental conflict of interest. It is the only industry where its consumers often do not know the price of the products and services they will pay for beforehand. In fact, I challenge any consumer to predict the price of a hospital stay before their copay coverage kicks and I guarantee you almost no one can guess the cost prior to the stay.

The entire kickback system for drugs and health care costs makes no sense. The HMO and PBM industries have incentives for profit and higher drug prices which run contrary to the interests of customers and general public health. It is ironic that PBMs were created to represent consumers and to keep drug prices down. However, their revenues are usually a percentage of the listed retail price so they effectively have an incentive to propagate the game of increasing drug prices with tied in rebates. It goes to show that proper incentives encourage proper behavior.

The current administration’s push to dismantle the Affordable Care Act will continue to hurt hospitals and others that benefited from the previous administration’s policies.

Medicine continues to push ahead with new drugs and other forms of cures and treatments. Hepatitis can now be outright cured. I suspect the “Cure for Cancer” is within reach. The methods to attack cancer are as varied as the forms of cancer and how it affects different people differently. Nanotechnology has been shown to destroy tumor cells. Biological compounds and pharmaceutical compounds have shown promise. Of course, with the Cure for Cancer and cures for other diseases create longer life spans which will test the Earth’s ability to sustain the growing population. Malthusian overpopulation is a very real threat to human existence as it creates even more tension for limited resources such as fresh water, food, energy, and supplies. Eventually our best bet as a species is to colonize the Moon, Mars, and beyond.

How does this affect Talguard? I focus on a select few pharmaceutical, services, and biotech companies that have demonstrated sustainable cash flow. Are they contributing to high health care costs? Yes, for sure, but they are also providing very real benefits and services to their end users and to society.

2017 Tax Bill and Its Implications For Our Investments:

Government policy can certainly affect businesses and the business climate psyche. However, I focus my efforts and make my decisions on investments based on the underlying business of each company invested. The 2017 Republican Tax Bill (the “Tax Bill”) caused a rally at the end of 2017 and into early 2018. Many stocks that rallied would most likely continue to rally since it made more sense to sell in the New Year for those who want to sell. I fully expected our investments to do well and they have.

The 2017 Republican Tax Bill and recent deregulation have a number of implications for the companies that underlie our investments:

- Corporate tax reduced from 35% to 21%.

- Increased deductions for capital spending.

- One time tax break for repatriation of overseas cash.

- A few provisions for lower regulations.

- Inequality and Trickle-Down Economics.

The first three will be generally good news for our investments. Many of our investments have a good share of their business in the United States. Numbers one and two above will increase their profits. For number three, the Federal Government is allowing corporations a onetime tax break to repatriate overseas cash. The top three points will generally benefit shareholders like us because much of the funds will be used for share repurchases and dividends. This is a benefit for continuing, long term minded shareholders like us. Some of these funds will be used for acquisitions and/or onetime special dividends. Acquisitions are a two edged sword that can either benefit or hurt shareholders. Acquisitions should be evaluated on a case by case basis. Special dividends are welcome assuming the Company does not have a better use of the cash. Savings from the tax bill can benefit consumers through the form of lower prices and potentially better products and services and it can benefit employees through higher wages. The Federal Government is taking on over $1 trillion in debt to fund this tax bill to lower corporate taxes and personal income taxes. In the long run, even the most stable governments have to be cautious about taking on excessive leverage.

The fourth point on lower regulations is a cause for concern. While it may seem to be automatically great for the business world that regulations were recently reduced, a word of caution is in order. It depends upon the industry and upon the amount of deregulation. The example I often cite is the fall of the Glass Steagall Act in regards to the banking industry.

The fifth point and the biggest concern is the implication of the Tax Bill towards society. The Tax Bill will continue the trend of inequality in America. Mass inequality led to the downfall of the aristocracy throughout Asia and Europe. Look what happened to Louis XVI, Marie Antoinette, the aristocrats, and the clergy in France. The population stormed the Bastille resulting in Louis XVI and Marie getting guillotined. We are now in an age where wealth is more concentrated amongst the ultra wealthy, at approximately the same level as during the Gilded Age of the 1890s.

The tax bill is a page from Trickle Down Economics that was highly pushed during the Reagan Administration. History has shown that Trickle Down Economics does not work in the long run. The Kansas State Government tried this approach with deep tax cuts and they found out the hard way it did not work. Kansas has subsequently reversed those tax cuts because the trickledown effect never materialized to create enough new tax revenues to cover the short fall. In the long run the last two points are net negatives for businesses. Put it another way, one wealthy person receiving $100 million in tax deductions will have a far lower economic multiplier than if that money went to 10,000 middle income families. The wealthy individual can only eat so much food per meal for example, and will put a substantial portion of that money into financial assets. The 10,000 middle income families will eat far more per meal and will spend far more thus creating a larger multiplier.

The bottom line is that the Republican Tax Bill and the 2018 Federal Budget are spurts for the economy in the short term but whether that will provide the long term boost remains to be seen. There is a risk this stimulus could push the economy to overheat.

Cash Flow Assets vs. Speculative Assets and the World of Cryptocurrencies:

There are only two types of assets in the world: cash flow assets and speculative assets. Cash flow assets are stocks of companies, real estate, and farmland that generate cash flow. Speculative assets are everything else where you hope someone will pay you more than what you paid for it. These include trading cards, the stocks of money losing companies, and tulips. You can guess which category I consider Cryptocurrencies (“Cryptos”) belong to. Yes, Cryptos are speculative assets that have reached speculative insanity. You will never find Talguard investing in theses speculative digital “tulips”, I only invest in cash flow assets. Cryptos have zero intrinsic value.

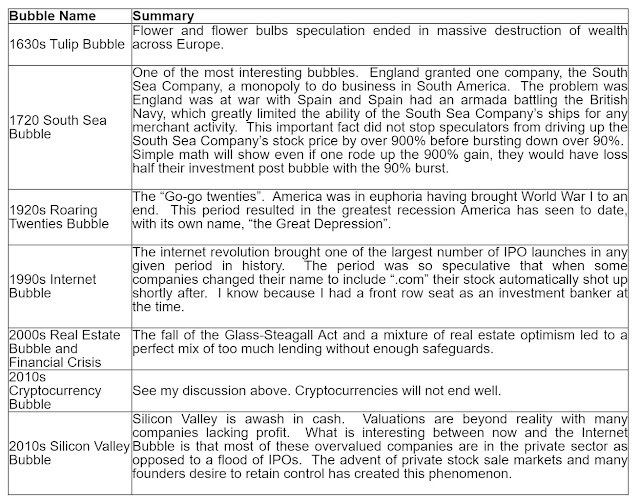

History is littered with speculative bubbles and none have come close to the current insanity of Cryptos.

- They are not currencies – Currencies by definition have ease of use and can serve as the complete intermediary for a transaction. Cryptos fail both tests.

- Potential for fraud – The most prominent cryptocurrency, Bitcoin, has no known creator. Some mysterious person has created this magical pixie dust and he gave himself a certain percentage of all Bitcoins. How do you know he did not create a backdoor to issue more units? How do you know if he was not the hacker who took 90% of Mt. Gox’s holdings, the largest Bitcoin exchange at the time?

- Security – For being so called “secured”, Cryptos seem to have a number of large thefts. Just last month hackers stole $690 million of digital coins.

- They are like an online video game – Someone can create Cryptos out of thin air and they keep creating new ones. There are already lots of online goods that people can buy from online trading cards to in-game goods for mobile games. The problem for investors is that they have no control over the quantity of virtual goods. How do you know if these creators didn’t create a backdoor to issue more units? In fact, anyone can just create their pixie dust crytocurrency out of the blue. Voila, instant digital coins!

- Storage – When you have to go to extremes such as downloading a hard drive, padding it, and placing it in a vault box, you are opening yourself up for high risk of loss.

- How do you know who will win if any? There are already hundreds of Cryptos and more can be created by anyone. There is no limit. Look what happened with first movers such as AOL and Netscape during the internet bubble.

- Initial Coin Offerings (“ICOs”) have no ownership value – Unlike a stock which gives you ownership in a company by law, you have zero ownership for these so called crypto offerings of the underlying company.

- Currency Fee - Cryptocurrencies have a transaction fee to process and they take some time.

- Regulatory pushback – Government will not take kindly to these unregulated mediums. They will fight for their own sovereign currencies.

- Payment processing pushback – Banks and credit card processors are treating Crypto purchases on credit cards as cash advances and will be charged 3% in addition to immediate credit card interest rates. This is on top of the 5% on average per Crypto transaction. This makes sense as Banks are trying to guard their own capital from such speculation.

- You know it’s a bubble when a company recently added the word “Blockchain” to its business name and its stock went up 394% in one day. In case you are wondering, the Company is On-line Plc that announced it was switching to a name called On-line Blockchain Plc.

Blockchain has some real world applications for banking, retail, and academia. However, it does not mean Cryptocurrencies have any value. It is not even clear Blockchain will remain a viable strategy in the long run. There are faster forms of distribution ledger technologies such as Hashgraph and Tangle.

Why I Study History:

Most people get excited about bull markets. I spend considerable amount of time studying asset bubbles around the world through history. Why? Learning from history has proven to be a solid way to avoiding the pitfalls of euphoria. Look at the large bubbles in modern human history and you can see it can come in all industries, shapes, and sizes.

Financial Services and FinTech:

This sector has yielded multiyear compounding all stars. I am quite satisfied with their performance and expect us to own these shares for the foreseeable future. Financial Services and Technology will have ever greater cross pollination in the years ahead. You are seeing this on multiple fronts including the worldwide, decades-long shift from paper currencies to electronic currencies and the push for faster and more secure transactions.

Banks:

There are a number of strong contrasting winds blowing at the banking sector, some positive and some negative. The yield curve has been flattening in recent months, this means the gap between short term interest rates and long term rates have narrowed. This is bad for banks because they generate profit from lending long term debt such as mortgages and borrow short term assets in the form of deposits. The Tax Bill on the other hand is a boon as most domestic banks have the bulk of their business in the United States. However, if interest rates do go up for an extended period, it will likely benefit banks.

Recent legislation will reduce regulations for banks. This may give a short term boost for banks in the next several years but it can be very dangerous in the long run through the decades. The Great Depression had a financial run on banks. The Glass-Steagall Act helped restore the confidence in the banking sector by severing commercial banking businesses from investment banking businesses. This helped prevent commercial banks from leveraging mortgage assets and deposits and investing in highly leveraged esoteric securities. The fall of Glass-Steagall unleashed a wave of ever increasing risk taking by banks. Commercial banks could package bundles of mortgages from whole city regions and slice them up by credit ratings and sell them and resell them through derivative markets. Thus Residential Mortgage-Backed Securities (“RMBS”) was born. This also resulted in the 2008 financial and housing crisis which gave us the Great Recession. Enter Dodd-Frank which is effectively a reincarnation of Glass-Steagall with a few less regulations. Now Dodd-Frank is being pushed towards the exit. I am a proponent of our banking system and the ability to allocate capital where it is needed. However, banks often will take ever greater risks without checks in place as they gather enormous amounts of deposits and can borrow cheaply from the Federal Government. The banks have real incentive to put that money to work.

Retail:

In my last Mid-Year Letter you may recall I discussed how Amazon and other online retailers have changed the face of retail and that has created a variety of opportunities for investment as the Market was overreacting, assuming Amazon will destroy all other retailers.

We have made substantial gains with two investments in these sectors. Both are what I call “Opportunity Stocks”. They will be held until they reach intrinsic value at which point we will par it down either to hold in cash or allocated towards other opportunities that arise.

Amazon is not the end all for retail. It has dominated online retail but does not have the entire universe of retail products that many profess it to have. Try buying a number of basic items such as cough medicine and bulky everyday products. Amazon often does not carry the items and when it does, it is often overpriced. The selection is often not there. Endless shelf space is often limited and sometimes a myth depending on the product you search. You can see major branded manufacturers starting to push back. While some companies like Nike have signed agreements, others have fought to keep copycats and third party retailers from selling their products at Amazon. Amazon’s cloud business is profitable. On the retail side, it is not clear Amazon will ever be able to significantly raise prices to generate a long term profit.

The retail landscape is changing and some who do not adapt will disappear. Sears, the subject of my discussion in the midyear letter, will continue to recede. Other retailers that have no economic moat will disappear. Will everything go online? It is doubtful that will happen in the near future. Online retail cannot provide products cheap enough for the lower income demographic and also heavier weight products. I maintain many products still cannot be found in anyone particular online marketplace.

Branded Manufacturers – Consumer Staples and Consumer Cyclicals:

We continue to own Core companies in this sector. Several have performed so well that they are well above intrinsic value. As I have stated in the past, I will size down Core Companies if they are vastly over intrinsic value and I have done so here. This sector includes consumer consumables (food and beverage) and consumer products.

There has been a multi-decade tug of war between manufacturers and retailers. The pendulum has often swung in each side’s favor over the decades. Right now, the advent of online retail has swung the pendulum in favor of retailers.

Food Subsector:

I want to take a moment to discuss food manufacturers, namely the large companies known as “Big Food”. Big Food has been getting punished by consumers and rightfully so. The backlash toward overly processed products with unnatural ingredients and loaded with excess sugars, sodium, and preservatives is very real. In the last 75 years since the advent of large scale factory production lines, the game played by Big Food companies has been to build big brands through large advertising budgets and then look for ways to cut costs on ingredients over time. Once a product catches on, these Companies will substitute an ingredient here and an ingredient there. This is often the case when they purchase a smaller, more natural brand. The modern consumer has caught on to this and is demanding fresh and natural ingredients. This has been done for shareholders and for management compensation. Another reason it has been done is to keep prices in check for price conscious consumers. I much rather see a focus on natural ingredients and less artificial additives. It is good business that way. Many consumers are willing to pay slightly more for better quality ingredients as evidenced by the growth in organic foods and new competitors in a variety of products. This also applies to non-food consumer products as well.

A glaring example of this food trend has been the yogurt niche. A company like Chobani came at the right time and the right place in offering a more natural yogurt. The old guard yogurt behemoths were not going to change their ingredients until Chobani came with a strong challenge and ate their lunch. Now you see larger companies swapping out preservatives and reducing sugars and fat content and launching new lines to compete. As a consumer I am happy to see this trend towards better quality foods. The center aisles of supermarkets where they have most of the processed foods that tend to have the highest margins will face great pressures ahead. As an investor, I welcome this change too.

These factors have created interesting opportunities in this sector. In the long run I favor branded manufacturers. They have a lot more staying power if done right as opposed to retailers. I particularly like those that produce simple products and services with dominant positions. These brands are already made with simple ingredients.

Technology:

The information technology, software, and financial technology subsectors of technology have been fruitful in our endeavors. See the Financial Services section for a discussion on I.T. We have done quite well with our investments here. To me hardware is like the canvas. Software is similar to the paint brush and mediums along with the artist. Both are important.

FAANNGT Tech Sub Sector:

This is a subsector of the Technology Industry much discussed by the media. FAANNGT consists of Facebook, Apple, Amazon, Nvidia, Netflix, Google, and Tesla and has drawn constant media attention. We have made our returns while generally avoiding the “most popular stocks”. I aim to take the road less traveled and try to avoid “beauty contests”. On the contrary, we have made substantial gains because of the fear these stocks have created amongst various sectors, especially the fear Amazon has created.

If you recall in the last midyear letter, I wrote extensively that Amazon will not take over the retail industry nor are they going to destroy all these adjacent industries. I find it funny that people think Amazon is the end all be all for retail.

A profound development in the world of social networking and online search platforms for the largest companies is that they have often usurped the role of traditional news media. Companies in this space claim they are just distributing information but in effect that have taken over as media outlets. In some ways, Social Media has usurped traditional news media in influence, especially amongst the younger generations. However, they are not regulated like traditional media or like utilities. It is amazing that companies such as Facebook and Google have been able to largely escape regulation in the United States. That time will be nearing an end as governments take a more active approach the risks of social media networks. You are already seeing push back from European governments.

There is going to be some regulatory scrutiny ahead for some of the FAANNGT stocks not just from the United States government but elsewhere in the world. There have been some actions already that have led to large penalties, such as in Europe, but that will only get more intense in the years ahead.

Restaurants:

Restaurants are a tough business. I personally worked on the successful turnaround of franchisees in the restaurant industry including Burger King Corporation buyout and its franchisees over a decade ago. I led negotiations between a variety of stakeholders on capital allocation and strategic initiatives so I have some expertise in this industry. This sector has been a mixed bag with some concepts taking a big hit. This has created some potential opportunities for us. As usual, I am very patient so we will see.

Every 10 years or so a restaurant owner has to do a midterm remodel that typically cost over $200,000 for a fast food unit, and over $350,000 for full service restaurants if they want to keep their units fresh. If you are a franchisee, it is often not a choice because the franchisor often will push chain wide initiatives. Every 20 years the restaurant owner has to pay for a major remodel that often cost more than $1 million per unit. Most restaurants do not own their real estate so owners have to pay base rents and a percentage of sales. Most restaurants are leased but some are owned outright and some have ground leases, also known as “sandwich leases”. If you are a franchisee, you have to pay initiation costs, royalties, and advertising dollars.

So why are Restaurants discussed? It is because it is within my circle of competence. It is also because a chain that is undervalued and is disciplined with costs can generate a long runway of cash flow. The recent pressures on the restaurant industry have created a few select opportunities. But you have to be selective in this industry. You need a company with a clearly defined niche that also provides good service and a margin of safety.

Insurance – Property & Casualty, Life & Health, and Reinsurance:

During my college days at U.C. Berkeley’s Haas School of Business, I interned at a boutique investment advisory shop, Corporate Finance Advisors, which specializes in the insurance industry. The insurance industry goes through periods of hard markets and soft markets. Hard markets are when premiums rise rapidly while soft markets are defined as lots of insurance companies chasing customers to sell coverage. This is often pretty risky as insurance companies pay charge insufficient premiums. The catastrophe P&C insurance and reinsurance market have experienced extended periods of soft markets around the world even with recent powerful hurricanes in the Atlantic and typhoons in the Pacific. The best time to write coverage if you are an insurance company is usually right after a disaster has struck. That is when most if not all insurance companies become scared of the payments and they pull out. If you have the courage to assess the situation and underwrite policies during this period of destruction, that is by far the best way to do it. That is the business nature of this industry.

In the long run, A.I. and self driving vehicles will weigh on the auto insurance industry. You are already seeing some of that with semi autonomous vehicles tested on the road. Fully automated vehicles have been tested too. One example in 2016 was an 18 wheeler that drove 120 miles from Fort Collins to Colorado Springs in Colorado to deliver a shipment of beer. In theory, accident rates will go way down. In the short term it will be business as usual for auto insurance companies. In the long run, the competitors in this space will have to adapt in order to survive.

Life & Health is a tough industry to successfully get right. Many people are living longer and the payments will often be much larger. China has been a huge market of opportunity as this concept has been relatively new to take hold. More Chinese will also have the income to set aside for a life insurance policy. In the U.S. and much of the Western World, life insurance has been a very difficult business to get right. Because of this I have avoided this industry.

The Mongols, Athenians, Chinese, and Globalization:

The Athenians proved that market forces, free trade, and funds for higher learning were a winning formula. Just look at their competition with their arch rivals, the Spartans. Sure, Sparta had a more powerful army and warrior class but they were also inward looking and sought to fund military above all else. Athens emphasized trade, free thoughts, nurturing of art, a fluent currency, and emphasis on education. Athens survived the test of time and Sparta did not. Go visit Sparta today and you will find there is not much left, it is a small village with ruins nearby to mark its ancient past. Athens went on to become a major city that gave the world everything from the idea of democracy to the idea of the Olympics. In this case, the pen is mightier than the sword.

Genghis Khan conquered most of the known world at the time creating an empire many times larger than the Roman Empire at its height during Emperor Trajan’s reign. Genghis Khan and the next two generations of Khans had a remarkable method that allowed his small clan to consolidate the Mongol tribes and then to conquer most of the known world. In the past Mongol tribes would attack neighboring tribes often for loot and plunder because life was harsh on the Mongolian Steppe. Defenders would flee while the attackers would loot first and then chase the fleeing opponents later. This was a problem for invaders because the fleeing tribe often would go to allies, regroup, and counterattack which created a perpetual cycle of raids. This lasted centuries. Genghis Khan created an equity system where each warrior would receive a share of the spoils based on their rank. He ordered his soldiers to first chase down and take out the fleeing enemies first and then return to collect their spoils based on the agreed upon share. This greatly reduced the possibility of counter attacks. Genghis Khan in effect created a form of equity.

His children and grandchildren expanded his empire to many folds. It was divided into four regions and each region would send goods and artisans to the other regions. Thus the Silk Road was greatly expanded and became one of the earliest forms of globalization.

History has shown countries that have closed their doors do not fare well. Sparta is one example but there are many others. Notably, in the early 1500s a Chinese emperor listening to ill conceived advice burned down China’s world dominating fleet of over 3,500 ships. The reasoning was that China had all it needed within its borders so it burned down the navy and merchant ships and closed down the Silk Road. China went through a prolonged period of decline that ultimately resulted in the downfall of that dynasty.

Ever since China re-embraced trade, it has stepped forward to the greatest GDP ascent ever seen by mankind and it is not done. It is now the “World’s Factory” with its manufacturing prowess. China ascent has funded its ambitions of space travel and world trade. The clearest example of world trade is The One Belt One Road initiative that is a modern version of the Silk Road. Contrary to popular belief, the Silk Road was not a single path through the Steppes and deserts of Asia. There were multiple roads that branched north to the Baltic kingdoms and south to India. A second component for the Silk Road was the water routes through the Northern Indian Ocean all the way to Africa. As Napoleon allegedly said, “Let China Sleep, For When She Wakes She Will Shake The World”. That has been an understatement.

We have had successful investments in China and many of our American investments have very large catalysts that have played out well in China. The opportunity set has been tremendous. Even with recent Chinese government scrutiny of foreign companies and potential trade wars, China continues to be a tremendous opportunity for those who know where to look.

The biggest concern is the tremendous amount of leverage in both the public and private sector in China today. It reminds me of what happened to South Korea and Japan during their modernization and globalization paths. In China, the rapid real estate appreciation has gone on for well over a decade at a breath taking double digit pace on the coastal cities and moved inland to a lesser extent. There is an asset bubble risk if you consider there is a limit to even the richest buyers on how much they can or are willing to pay per square foot. It happened with Class A real estate throughout the United States in 2007 and it can happen in China. Cap rates descended to sub 3% and even 0% in some cases such as commercial office towers within walking distance to the Capitol Hill in Washington D.C. It happened with Japanese and Korean high profile purchases in the United States during the 80s and 90s when many entities overpaid. The current amount of leverage in China is not sustainable because at some point the math does not work.

I am quite optimistic on China’s prospects and the Country is starting to produce some global brands. Pound for pound though, I have always been the most optimistic of America’s prospects. Even with the recent political dichotomy in the U.S., America is where we have and will continue to deploy most of our capital.

Why I Avoid IPOs:

Initial public offerings and their related cousins, Secondary Public Offerings, are almost always a terrible deal for investors who jump in at the beginning. I was an investment banker at Bear Stearns long before it closed down and has seen how IPOs are valued and priced from the inside.

IPOs are priced with ridiculous, fantasy like valuations. Review the financial projections for these companies and you will see an even more absurd fantasy of geometrically growing revenues. This is often referred to as a hockey stick because if you trace a line over these projections it starts off with a smoother curve and it rockets upwards to infinity. Trees grow to the sky but not to outer space.

It is curious that nearly all companies issuing an IPO have such overly optimistic assumptions. It reminds me of Major League Baseball’s Spring Training where fans of each team all believe their team will win a 100 games and win the World Series. That is simply not reality.

Yes, there will be grand slams that arise from IPOs for investors. However, I am here to point out that for every home run in IPOs, there are many more strike outs. There are quality companies that go public but investment banks do not give you much time to understand the financials and other fundamentals of these companies. They also are often priced to perfection. That is why you see so many stock prices of IPOs take a nosedive soon after. Better to take your time to understand a company and the underlying investment than to jump in blind.

Why I Do Not Short:

Shorting, also known as a “Short”, is an extremely risky game to play that consumes a lot of your time and energy. If you go Long, where you are buying a stock, you are investing with a Company as a co-owner as its business grows. Shorting inherently means you are betting that a company will fail and that there is potentially underlying fraud associated with it. If you go long, the most you can lose is your investment if you do not buy with margin. However, your upside is potentially infinite as there is no ceiling plus you will be collecting any dividends paid.

If you go Short and bet that a stock will go down you have to borrow the shares from your investment broker. They will charge interest while you have your short position. The most you can make is double your money less the interest expense and transaction fees. However, your downside is infinite. Let’s say you are wrong and the Company does well and it goes up 10 times. In that case you have loss over 9 times your money. You can hedge your investment but that comes at a cost as well. Shorting elevates pressure to constantly observe a stock and to me it is generally a much more stressful endeavor.

Shorts have a place in society in that it helps to uncover fraud. However, that is not my game. I much rather sleep easy at night by investing in the long term potential of companies. The stock market has inherently gone up for the most part over the long run so shorts are also swimming against the tide in this case. I have found it much more profitable and better use of time to invest and buy the stocks of companies for the long run.

Why I Do Not Employ Leverage In Purchasing Stock:

Using leverage to purchase stocks, as known as “buying on margin”, is another dangerous game to play. In other words, it is buying a security by paying the margin portion and borrowing the remainder from a lender, usually a broker or bank. It increases returns more when your investment goes up. However, it can wipe you out quickly if the investment goes the wrong way. The Market may push your investment down in the short run against what you expect and the leverage can wipe out your initial investment quickly.

My philosophy is not to risk our partnerships assets with any form of leverage where it can put us in a bad position. Plus you can miss out on opportunities when you are over levered and Mr. Market over corrects asset prices downwards. The worst thing about purchasing stock on margin is that if a downturn comes, the lending institution can issue a margin call in a downturn. You then have to come up with additional funds within a few days or the lending institution can sell your stock positions for you to cover their margin. This is a situation that is best avoided. Borrowing to purchase securities, even in small amounts, can warp your mind and cause undue stress. Leverage to purchase stocks is a form of risk that I avoid and is a segue to my next discussion.

Risk – What Is Risk To Most People And How I View Risk:

So what is risk to investors? For many, it is about volatility, when a stock price changes fast. Whether a stock goes up or down it is called risky simply because it changes fast. That is the concept of Beta. This concept makes no sense to me and I will tell you why.

I attended three of the top universities in the world and they all teach and even preach that the Market is always efficient and that Beta is the most important factor to measuring a stock’s risk. I find both of these ideas preposterous.

Beta says the main measure of risk for a security is its volatility. A hypothetical stock that drops from $100 per share down to $60 per share is considered more risky because it dropped $40 per share. That makes no sense. To me if this stock represents a great business, then it is way less risky to invest when it has dropped to $60 because I am getting more bang for the same buck. I am getting “value”.

Beta assumes that the current quoted price of a security is perfectly correct in capturing the value of a security. In reality, the value of a stock or any security is constantly changing based on how the Market perceives it. If the market is perfectly efficient than why is the 52 week low and high for the same stock vary by double digits for almost any security that is traded? Sometimes the difference is greater than 50%. That can’t be true for every business. It goes to show the Market does value stocks like a voting machine in the short run but it is a weighing machine in the long run, as Ben Graham and Warren Buffet have stated.

It is not risky to me if you understand the businesses you invest in. It is similar to purchasing your home. If you do your homework and understand the type of property you bid on and the surrounding location, there is very little relative risk.

To me, risk is investing in what you do not know. Risk is also getting swept up in the current fad that the media and everyone around you are seemingly talking about, such as Cryptos. Risk is investing in too many companies that you cannot possibly know every investment. That is what many funds do, they invest in possibly hundreds of securities hoping that the diversification will protect them. To me, that is risky because it is basically saying you don’t know what you invested in and it is a proxy for ignorance. Most funds ultimately have one decision maker or if it is passive will just invest in a big basket of stocks. Either way, you will become the Market where you have all the good companies but also all the bad companies. No matter how big an active fund is, it still ultimately has one decision maker. How can that person possibly claim to understand hundreds of companies and follow a universe of thousands all at once? Even if they have a legion of analysts working for that fund, it is still one decision maker who needs to really understand each investment before allocating capital.

To me, it is less risky to thoroughly research your ideas and stay in your circle of competence which allows you to concentrate your positions. In other words, I find and track great companies that fit my business criteria. I wait patiently for the right price or other factors that the Market has missed. When the conditions are right, I strike and strike hard. In other words I will “back in the truck” to load up on the right opportunity.

Inflation and Interest Rates:

We have had a 40 year run of interest rates being pushed down by the Federal Reserve Bank. There is not much room for the Federal Reserve to lower rates any more unless they want to go into negative interest rates. Negative rates would produce new problems as experienced by banks in Spain when they tried it. They initially had to pay borrowers interest for mortgages which those banks fought against.

For those who think stock valuations are high they are sorely mistaken if they think bonds and debt investments will offer better protections in a downturn. No one knows whether rates will go up after a 40 year decrease but odds are that they are likely to go up instead of down. They can also stay the same. With the recent tax bill providing more short term stimulus and the economy continuing to hum, the Fed will be pressured to increase rates. If rates go up, it does not take much to impair debt investors. First off, interest rates from higher up in the capital structure in treasury bonds down to high yield bonds are already near historic lows. It does not take much of an interest rate increase to severely decrease bond principals.

Interest rates and inflation go hand in hand similar to cookies and milk. Higher inflation almost always means central banks, particularly the U.S. Federal Reserve Bank, will raise interest rates. There have been a number of powerful deflationary forces that have aligned to create a decade of low inflation. These forces along with one of the deepest recessions in history have caused the Federal Reserve to lower rates to the lowest in history. The short term Fed Funds Rate was zero for almost 8 years. During this period the Federal Reserve also launched an unprecedented amount of quantitative easing. It basically flooded the Market with massive supplies of dollars. Central Banks from around the world followed the Fed’s lead in subsequent years and in some markets that continue to have quantitative easing. Some Central Banks took lower interest rates to a more extreme having gone negative in some cases such as in Spain.

Below is a summary of inflationary forces and deflationary forces in the past two decades.

The extraordinary convergence of the deflationary forces listed above has kept prices in check in recent years but we are starting to see that pendulum swing in favor of more inflation. The world’s consumption of energy will continue to grow fast as economies grow and technologies advance. Quantitative easing has ended in the U.S. and in fact the Federal Reserve is swinging the other way on a slow and steady basis. Nationalistic movements across the globe are pushing the potential for trade wars and tit for tat tariffs. You already see some of that as the U.S. has stepped up tariffs on some Chinese industries. NAFTA is being renegotiated and its future remains in doubt. The U.S. pulled out of the Trans Pacific Trade Agreement started by the previous U.S. Administration to counteract China’s trade prowess in the Asia Pacific Region while the new U.S. Administration withdrew from the deal. It is noteworthy that the remaining countries led by Japan decided to push ahead and finalize the agreement without the U.S. Shale and Fracking have unlocked tremendous amounts of oil and other fuels which has led the U.S. to be the largest oil producer in the world. That created an excess of reserves when oil prices collapsed that is now starting to reverse.

So what will happen with stronger inflation? It will definitely affect some industries for the better and others for the worst. Transportation and retail that cannot pass through the costs as well will be hurt. Airlines are a classic example as so much of their expenses come from variable costs such as employee compensation, food, and fuel. That is why I luck industries such as branded manufacturers that have a very strong brand. This brand and loyalty will give them the power to pass through the costs especially if they are lower priced items by nature. The trick is to find these companies in the age of diverse consumer tastes. Hard assets can also benefit from an inflationary environment. I tend to avoid commodities. The companies in this space often have zero pricing power, they are often price takers. The only way to win is to be the lowest cost producer and that is often a dangerous game to play if you are an investor seeking long term consistent cash flow.

The next great leaps forward for mankind appear to be what I dub the Micro Intelligence Age. We had the Bronze Age in antiquity through to the Industrial Revolution Age in the 20th Century to the Information Age at the beginning of this Century. One thing is for sure, each Age is getting shorter. The Micro Intelligence Age stems from powerful advancements in the microscopic level driven by artificial intelligence in technology and advanced compounds in medicine. Will these forces be inflationary or deflationary? It is too opaque to say for now but they will definitely have an impact on how humans live going forward.

Compounding Returns:

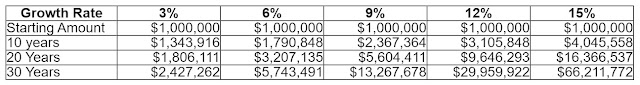

I want to reiterate the power of compounding returns. Look at the chart below demonstrating scenarios where a $1 million investment compounded at varying degrees of returns.

You can see a large degree of difference of just a few percentage points has tremendous effect on the outcome. Investments with compounding returns over the long run are exactly what I seek for our partnership. This is a hypothetical chart, we do not guarantee any results in any way.

What’s Next:

So where does all this leave us? There has been some volatility in stock prices and some concern amongst the financial community. There have also been a lot of indications of positive enthusiasm for the coming year and going forward. However, I make no attempt to predict where the Market will go in the short run. The good news is that my methodology of uncovering great companies and having the patience for a good price provides compelling opportunities in any market environment. This creates the opportunity to be invested for the long run.

There has been a 40 decade run of lower rates, that won’t last forever. At some point something will cause rates to go up or fluctuate. A prime suspect is inflation. I do not profess to know or predict when that will happen. Other factors can create downturns. When it does happen, and volatility returns with a vengeance, we will be ready just like we were for the last downturn.

Summary:

I am more sure than ever of America’s long term prospects. I also like the prospects for China and certain European economies in the long run. There will be a real pull back in asset values at some point but that is all temporary. I will be ready to strike and strike hard just like I have in past down turns. I like to invest when others are fearful.

I view each investable dollar as a soldier standing patiently and silently on top of a mountain looking at the field. My soldiers comprise a patient army waiting for the right opportunity. When the opportunity comes, my army of investable dollars will attack.

At Talguard, we are dedicated to an old craft, and we run on old principles. I view stock as being a co-owner of the underlying business in that security.

We know there are opportunities out there. We know we can find them. I guard your assets and grow your assets as if they are my own. I aim to be the best investor of my generation.

For existing investors, I guard and grow your wealth over the long run. Compounding returns over long periods of time is one of the most powerful forces in the Universe.

For new investors, contact me and learn about my dedicated long term investment process and how Talguard can help you preserve and grow your wealth.

Contact us today at investors@talguard.com.

Best,

Dan H. Chen

President

Talguard Investments LLC

Dan’s Background:

Dan is the Founder and CEO of Talguard Investments LLC. He has a passion for equity investments and founded Talguard because he saw an opportunity to provide investors a concentrated long term equity solution based on his own unique experience and circle of competence. Dan has over 18 years of experience and is focused on seeking equity investments that generate compounding returns over the long run.

Talguard seeks to preserve and growth investor wealth by providing a concentrated equity investment solution. Talguard focuses on finding quality companies with durable competitive advantages, waiting patiently for a margin of safety or other investable reasons, and then striking hard by committing a sizeable position.

Prior to founding Talguard, Dan was an Investment Analyst in the portfolio management team at Ares Management. He was responsible for the evaluation and investment of Companies in business services, informational technology, real estate, industrial products, and consumer products. Ares Management is a private investment company with over $100 billion of assets under management that invests in equities, bank debt, high yield bonds, and term loans.

Prior to Ares, Dan was an Assistant Vice President at Trinity Capital where he successfully led negotiations between multiple stakeholders in a variety of restaurant companies including the private equity buyout and restructuring of Burger King Corporation. Trinity Capital LLC is a restructuring shop focused on the restaurant and real estate industries.

Prior to Trinity, Dan was an Investment Banking Analyst at Bear, Stearns & Co. Inc. where he was responsible for creating financial models and presentations in advising the management teams of Fortune 500 companies. Dan was part of teams that successfully completed 11 transactions totaling over $3 billion that included IPOs, secondary offerings, mergers, acquisitions, divestitures, and hostile takeover defense. Industries covered included Financial Services, Consumer Products, Technology, Insurance, Health Care, Media, and Entertainment.

Dan received an MBA from the Anderson School of Business at UCLA as part of the fully employed program while at Ares Management. Dan received a B.S. in Business Administration from the Haas School of Business at U.C. Berkeley. Dan studied abroad and received a S.A. from Tsinghua University in Beijing graduating top of class.

Disclaimer Statement:

This document and information herein represents the views of Talguard Investments LLC and is not to be considered investment advice. The information herein should not be considered a recommendation to purchase or sell any particular security or financial instrument. There can be no assurance that any securities discussed herein will remain in the Talguard Value Fund LP.

This document does not constitute an offer to sell or a solicitation to buy membership interests in the Talguard Value Fund LP. Past performance is not necessarily indicative of future results. All information provided herein is for informational purposes only.

Investment in the Fund will involve significant risks due to, among other things, the nature of the Fund’s Investments (as defined herein). Investment in the Fund is suitable only for sophisticated investors and requires the financial ability and willingness to accept the high risks in an investment in the Fund. No assurance can be given that the Fund’s investment objectives will be achieved or that investors will receive a return of their capital.

In making an investment decision, prospective investors must rely on their own examination of the Fund and the terms of this offering, including the merits and risks involved. Prospective investors should not construe the contents of this letter as legal, tax, investment or accounting advice. Prospective investors are urged to consult with their own advisors with respect to legal, tax, regulatory, financial and accounting consequences of their investment in the Fund.

©2018 Talguard Investments LLC, all rights reserved.