We concluded the first half of 2019 with a strong return. We were able to rise despite playing defense by having more cash on hand now. Make no mistake, I have positioned us so we are ready when opportunities arise. The four major Market items of note are the U.S. and China Trade War, the U.S. Federal Reserve policy, corporate earnings, and the Debt Conundrum. These are the same major factors affecting the Markets as I discussed in the last annual letter. Before I get into it I want to note that if we find a good opportunity in a market leading business that we like, we will invest regardless of all the background noise. Now on to the four points affecting Markets.

1. U.S. – China Trade War:

There is unlikely to be a permanent trade deal in the near future, especially one that gives each side what it seeks on a long term basis. This will likely hurt the U.S. and Chinese economies in the near term. Even if there is a deal, there is a possibility the next U.S. President will want to change it or get rid of it. Due to the gerrymandering of our federal political system, the two parties have much less reasons to compromise. This has happened in Congress for the past two decades and now it has moved into the Executive Branch culminating in the current administration’s all out goal of rubbing out previous administration policies. This is likely to continue with the inflammatory political environment that we are in.

If you examine the history of tariffs in America and also other countries, the evidence is quite clear that blanket tariffs do not work. It ultimately is a tax on the businesses and consumers of the countries that instigate the tariffs. Free trade has tremendous benefits for recipients that are not seen as easily. It produces savings across the board for consumers over the long run. There is a reason rich cities and countries have practiced and pushed for trading. All countries have used tariffs throughout history and they are in effect today. That includes the U.S. and other western countries who push free trade. The U.S. uses tariffs too for a variety of basic materials and finished products. Plus the U.S. has mass subsidies for a variety of industries, the largest being the farm subsidies. Besides subsidies, the U.S. government will commit to purchasing some of the products of these subsidized industries to prop up prices.

I spent time in Hong Kong and Mainland China and there were a few revelations. China is way ahead of the United States and the rest of the world in the payments game. China has the most advanced touch less payment ecosystem in the world and it has significant market participation. Cashless and touch less payments are so embedded in Chinese society that street beggars have cardboard backed cutouts with payment ID codes on them so people can scan to give them money.

Many supermarkets and restaurants do not even accept hard currency. It really hit home when our private driver stopped at a gas station to refuel. At that convenience store, we picked up a few snacks and a store worker was standing in front of tall blue screens asking us to scan our products. We were expected to pay with our mobile phone. After some confusion, a worker behind the counter figured out we wanted to pay by hard currency since our mobile app we downloaded did not work so she waved us over. It was not often people pay by hard currency she mentioned and she called our money “ancient money”. Contrast that with American payments. It took years after Europe smart chip cards before U.S. retailers adopted the technology. Many payments are still processed by a variety of methods. Meanwhile in China, almost every consumer purchase is done digitally in consolidated apps and in touch less form. America is far from integrating touch less payments and there are zero consolidated apps for payments.

China is also leading in a variety of consumer technologies. It is a top two competitor alongside the United States in the race for artificial intelligence (“AI”). It has a faster embrace of consumer robotics and as already discussed a faster embrace of payment processing. China is now the main competitor to the race for 5G connectivity. Whoever gets there first will have the opportunity to formulate the rules that future wireless apps and software are written on. Most of the Chinese population skipped the lan line times and leapfrogged into mobile devices.

|

| The Federal Reserve is trying to get ahead of a recession. |

2. The Federal Reserve:

The Federal Reserve is now too much of an agent of the Market and its nonstop propping up of asset prices is a huge volatility trigger. In December 2018, the Federal Chairman stated how it wanted to tighten credit. Then after unprecedented criticism from a sitting President, the Federal Reserve reversed course and said they would be accommodating in keeping interest rates low. Now the Federal Reserve communicated that they are going to cut rates.

The Federal Reserve is trying to get ahead of a recession. In 1998, the Federal Reserve preemptively cut interest rates due to the 1997 Asian Financial Crisis and it helped the Market boom for 1999. However, that story ended in 2000 with a massive asset bubble that deflated so that preemptive cut did not work out. Other times when the Federal Reserve switched directions hard, it caused Asset Prices to fall significantly. My point is that trying to stave off downturns is ultimately futile and bad for the economy. Down drafts is a natural way to clear excesses in different asset classes. It is akin to nature having smaller fires in a forest that helps prevent a fire that consumes most of the forest. It is also like smaller earthquakes releasing stress in the major fault lines to prevent large ones.

3. Corporate Earnings:

It is remarkable that growth at major markets such as China, Germany, and in some U.S. sectors have slowed yet asset prices can continue to appreciate. The tax cuts from the current U.S. administration have already worked its way through the system for valuations. Valuations continue to reach new highs due to the extreme dovish policies of the U.S. Federal Reserve and other central banks around the world. Every time the punch bowl needs to be taken away because the Market has gorged, it is returned as the effects wear off from earlier stimulus rounds. This creates a situation where the hangover the next day will be even larger and the headache more severe.

4. The Debt Conundrum:

The yield curve has inverted twice already. Corporate debt covenants, which are provisions for credit investors' protection, have receded significantly to the point of pre-financial crisis. Debt yields for the entire spectrum from investment grade debt to high yield “junk” bonds have decreased significantly. Federal debt interest rates are near all time lows again. Germany’s debt yields continue to go further negative. Spain and Japan have near zero or negative interest rates for quite some time. Debt is certainly an area of potential extreme volatility going forward. If people think equity valuations are high, many debt investments are priced for beyond perfection.

Many will say where else can we go. There are ways to safe guard assets that do not involve buying covenant-light, low yield debt investments or high growth negative cash flow equity investments.

America’s Continued Economic Prowess and the Opportunity in China:

I am a firm believer in the economic prowess of America and its businesses. We have developed a magical place to do business that has been unseen in human history. America has the physical infrastructure, economic infrastructure, world class universities, and the capital markets that have unleashed the human mind like never before. And America has done it in a very short period of time in human history.

Consider the following fact. A million dollars invested in the S&P without knowing anything about stocks in 1928 before the Great Depression would be worth over $850 million today. If you invested that same amount in gold it will be worth approximately $4.3 million today. U.S. stocks have outperformed gold by several hundred times. U.S. stocks have also significantly outperformed other asset classes including real estate, corporate bonds, and government treasuries. American stocks achieved this success even experiencing the Great Depression, two world wars, the Korean War, the Vietnam War, terrorist attacks, 12 regional conflicts, and 13 recessions. As you can see, investing in American stocks has been a winning strategy over the long run.

America has a remarkable system that has unleashed tremendous human potential. It has the right mix of infrastructure, educational system, entrepreneurial spirit, and freedom of thought process that has set up a national systemic advantage. America has also gathered an extraordinary number of creative minds and hard working people from other countries as they are attracted to the American Dream. The proof is in the pudding. America continues to be a top choice for people seeking opportunity and prosperity. For example, if you were to offer everyone an opportunity to move anywhere in the world free of cost and immigration restrictions, I strongly believe America would be the preferred choice for many people. Net migration continues to favor America. Furthermore, many of the world’s elite continue to send their children to American universities.

China has bountiful opportunities as it has created its own form of capitalism that has yielded astounding results. As Napoleon famously said, “Let China sleep, for when she wakes she will shake the world.” China has not only awakened but she has roared and thunder shook the world.

Side Note On Reading:

I read a lot. One of the reasons I am thrilled with my profession is because if you want to do it well you need to read. I am reading to ascertain facts about companies. This suits my personality and love of reading and curiosity. I have a lifelong love of libraries and hope the concept of libraries will live forever in the age of digital books.

It was a magical day when my second grade teacher took my classmates and I to the city library, one of the best field trips I have ever had. I think it should be a requirement that all schools schedule a field trip to their local city or county libraries. I love the smell of books new and old. I have learned many great things from the treasure trove of books and publications I have discovered from libraries. In other words, many great things that have happened to me are because of my discoveries in the library. I often tell people I read and think for a living and encourage everyone to have a lifelong love of reading.

In addition to reading, I spend numerous hours investigating companies and keeping track of companies we have investments in. It requires dedicated time and efforts. That is what many people get wrong about investing, they think they can just buy what they know or like and be done with. That is less than half the battle. Worst yet, some will invest based on short pitches from commentators on television or from the grapevine of their network without doing their own research. You need to learn about a company for yourself and understand what makes it tick. You have to understand the financials. You have to investigate how a company really makes its money. You have to look into whether a company has durable competitive advantages.

Spending a great amount of time reading about companies, their businesses, and their competitors is a full time occupation. This is the minimum and it does not guarantee success. Financial well being is similar to health well being. For the best outcome, you would hire a physician for your annual check up or a dentist for your teeth. You would not do it yourself. For many who have a full time occupation that is not in investing, it makes sense to have a professional to manage financial well being.

Talguard Value Fund LP is a private investment fund that seeks to preserve and grow wealth by investing in the equities of companies with durable competitive advantages purchased with a margin of safety. The goal is to beat the Barclay Hedge Fund Index over the long run.

I am looking for a very specific type of company for investment. These companies are often #1 in their niches, have many years of consistent and growing cash flow, and certain other attributes. Most importantly, these companies often have multiyear catalysts that will generate value over time. Once identified, I will seek a discount to intrinsic value prior to investing. However, I rather invest in great companies at fair valuations instead of fair companies at great valuations. What I seek are often multiyear compounders.

Our portfolio consists of two groups of investments. The first group I call “Core Companies” that will often stay in our portfolio for the long run. These are great companies that I invest in either at discounts or at reasonable valuations. Core Companies have long term catalysts that can often span a decade or longer. For these Core Companies, holdings can be lowered when valuations are too high and they can be added on when prices take a dip.

The second group of investments that we hold is what I call “Opportunity Companies”. The Market usually has discounted these companies heavily either because of a short term weak earnings quarter or several quarters, an idiosyncratic sector selloff, or other very specific reason. I like to invest with a discount to intrinsic value here but I am also patient. Patience can result in Opportunity Company stocks providing a larger discount to intrinsic value.

As an emerging fund, we have a distinct advantage over large funds. We can be nimble while they often have to follow esoteric rules. Just because a well known fund is larger does not mean it performs better. In fact, a variety of studies have shown that emerging funds have often outperformed these larger funds. The most significant example is a comprehensive study produced by Nick Motson, Andrew Clare, and Dirk Nitzche, three finance professors at the City University of London. They surveyed 7,261 funds for 20 years from January 1995 to December 2014. They found that the largest 10% of funds returned an average of 7.32% a year for a total of 410.8% return over those 20 years. The smallest 10% of funds returned an average of 9.00% a year for a total of 560.4%. A $1 million investment in the largest funds category results in a balance of $4.1 million while the same investment in the smallest funds category results in a balance of $5.6 million. Of course, past performance is no guarantee of future results but the historical evidence is there.

A number of high profile large funds not only continue to underperform the Market over multiple years, but they have negative returns while the Market has enjoyed a near decade bull run. Larger funds do not necessarily translate to better results.

On a separate note, my strategy has an advantage that many emerging funds do not possess. Talguard has invested primarily in large cap and mid cap companies which means our strategy is highly scalable. Many emerging funds are focused on small cap and micro cap companies. These emerging funds cannot take on too much more capital for their strategy investing in the same small cap companies because the float on those shares is much smaller. These emerging funds would alter the Market for shares of these small cap companies which means prices can go down significantly when they sell or up when they buy. In other words, micro cap stocks are more prone to big price movements from the buys and sells of a large buyer as compared with larger companies. Talguard has the advantage here because many of our investments have sufficient volume and liquidity when we buy or sell.

Summary:

I view each investable dollar as a soldier standing patiently on top of a mountain looking at the field. My soldiers comprise a patient army waiting for the right opportunity. When the opportunity comes, my army of investable dollars will attack.

At Talguard, we are dedicated to a powerful craft, and we run on long term principles. I view owning stock as being a co-owner of the underlying business in that security.

Our expertise in the U.S. and China in particular has provided investors with a way to invest in two of the leading markets in the world. And yes, the current trade war does not damper these opportunities in the long run. Remember, some of these companies have benefited from the current disputes as well and some companies we invest in are not as dependent on trade between the two countries.

We know there are opportunities out there. We know we can find them.

I guard and grow your wealth over the long run. Compounding returns over long periods of time is one of the most powerful forces in the Universe. I want to fully take advantage of compounding returns and the best way to achieve that is to find #1 companies with long term cash flow prospects and investing at a reasonable price.

For potential investors contact us today at investors@talguard.com.

Best,

Dan H. Chen

President

Talguard Investments LLC

Dan H. Chen is the Founder and CEO of Talguard Investments LLC. He has a passion for equity investments and founded Talguard because he saw an opportunity to provide investors a concentrated long term equity solution based on his own unique experience and circle of competence. Dan has over 18 years of experience and is focused on seeking equity investments that generate compounding returns over the long run. Dan has a rich set of experience in both the “Buy Side” and “Sell Side” of the finance industry. He has experience investing in a wide variety of industries. He has direct experience in the equity, debt, and real estate asset classes. Because of his wide experience, he has seen why equities have proven to be the most successful asset class. Dan is a “Quality Investor”. He looks to invest in the equities of businesses that have certain attractive qualities such as being the leader in their niches and long term positive cash flow.

Prior to founding Talguard, Dan was an Investment Analyst in the portfolio management team at Ares Management. He was responsible for the evaluation and investment of Companies in business services, informational technology, real estate, industrial products, and consumer products. His team was directly responsible for over $10 billion of investments at the time. Ares Management is a private investment company that currently has over $100 billion of assets under management that invests in equities, real estate, bank debt, high yield bonds, and term loans.

Prior to Ares, Dan was an Assistant Vice President at Trinity Capital where he successfully led negotiations between multiple stakeholders in a variety of restaurant companies including the private equity buyout and restructuring of Burger King Corporation. Trinity Capital LLC is a restructuring company focused on the restaurant and real estate industries.

Prior to Trinity, Dan was an Investment Banking Analyst at Bear, Stearns & Co. Inc. where he was responsible for directly working with CEOs and CFOs, creating financial models and presentations and brainstorming ideas in advising the management teams of Fortune 500 companies. Dan was involved in the successful completion of 11 transactions totaling over $3 billion that included IPOs, secondary offerings, mergers, acquisitions, divestitures, and hostile takeover defense. Industries covered included Financial Services, Consumer Products, Consumer Services, Technology, Insurance, Health Care, Media, and Entertainment.

Dan has co-authored a book called “The Secrets Of Chinese Wisdom” with Amy C. Lee to teach people how Chinese sayings and wisdom from the past several thousand years have relevance to success in the modern world.

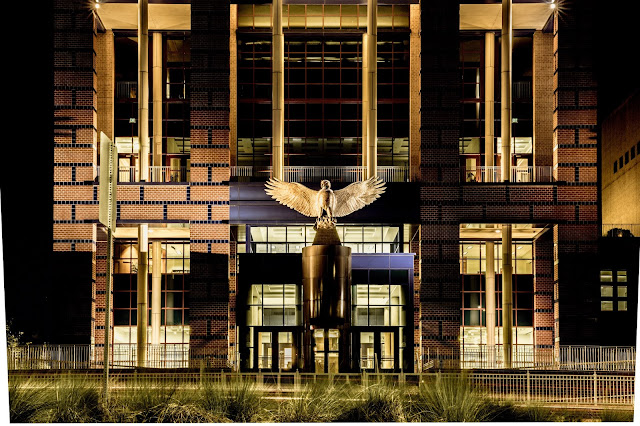

Dan’s favorite activity is to read. He reads broadly in non-fiction, company filings, business news, and business autobiographies. Dan believes that mentors can be alive or dead as their words live on through their written thoughts. One can learn so much from reading. Dan is a lifetime member of Friends of the El Segundo Library. He helped fund the development of the new area of the library where patrons can study and enjoy interactive activities. He hopes libraries will continue to provide a vital role in the expansion of knowledge for humankind even in the face of digitization.

Dan is a member of the Young Physicians & Professional Alliance of Torrance Memorial Hospital (“YPPA”). He believes in the cutting edge facilities and the staff that provides quality healthcare at affordable prices to the surrounding communities. Dan has donated to fund the development of Torrance Memorial’s Pediatric/Young Adult Pavilion launched in 2018. Dan is a big believer in science and its role in the future of humanity. He supports the Griffith Observatory and has been a Friend of the Observatory.

Dan has recently received accreditation from Harvard University with an EDX certification. Dan received an MBA from the Anderson School of Business at UCLA as part of the fully employed program while at Ares Management. He received a Bachelors of Science in Business Administration from the Haas School of Business at the University of California at Berkeley. While attending U.C. Berkeley, Dan studied abroad at the prestigious Tsinghua University in Beijing and Beijing Normal University, graduating top of class.

Disclaimer Statement:

This document and information herein represents the views of Talguard Investments LLC and is not to be considered investment advice. The information herein should not be considered a recommendation to purchase or sell any particular security or financial instrument. There can be no assurance that any securities discussed herein will remain in the Talguard Value Fund LP.

This document does not constitute an offer to sell or a solicitation to buy membership interests in the Talguard Value Fund LP. Past performance is not necessarily indicative of future results. All information provided herein is for informational purposes only.

Investment in the Fund will involve significant risks due to, among other things, the nature of the Fund’s Investments (as defined herein). Investment in the Fund is suitable only for sophisticated investors and requires the financial ability and willingness to accept the high risks in an investment in the Fund. No assurance can be given that the Fund’s investment objectives will be achieved or that investors will receive a return of their capital.

In making an investment decision, prospective investors must rely on their own examination of the Fund and the terms of this offering, including the merits and risks involved. Prospective investors should not construe the contents of this letter as legal, tax, investment or accounting advice. Prospective investors are urged to consult with their own advisers with respect to legal, tax, regulatory, financial and accounting consequences of their investment in the Fund.

©2019 Talguard Investments LLC, all rights reserved.