We had another great year and we once again beat our competition, the average of over 3,000 private investment funds from around the world that comprise the Barclay Hedge Fund Index. What has me even more excited is that we were able to achieve these results while playing defense. Make no mistake about it, we continue to play defense with our portfolio. We sold off some losers for the year so expect that in next year’s tax returns. Our gains have been substantial and we kept almost all our winners. We have held more cash on hand but have been able to make money with that cash waiting for the right opportunities. We are looking at companies that held steady or even grew in the last recession. As I have discussed in the past and I think it is worth repeating, we want to preserve and grow wealth over time. Most importantly, my strategy is highly scalable as we continue to grow our wealth together.

I strongly believe we are positioned well in case there is a downturn because I am cognizant of the recent run up in the Stock Market and many other asset classes. However, that does not mean you want to sell everything and “head for the hills”. I have heard from some people who have sold out or continue to reduce their equity positions out of fear of overvaluation. My answer is that they would have missed out on substantial gains. As mentioned, many of our investments have been compounding for years and as long as their durable competitive advantage stays with them, we will continue to own their shares. I can not predict what will happen to the Stock Market in the next several days or months. I can predict if those who hold the equities of businesses with durable competitive advantages over the long run will do well. I am investing for the next 10+ years, not the next 100 days.

We did and will continue to make investments with what we always do, which is to invest in companies we deem to have durable competitive advantages, companies that treat shareholders fairly, and are reasonably priced. Overall I seek to invest in “Number Ones”, which means I seek to invest in the equities of market leaders in their respective industry niches.

We head into the New Year and New Decade with a sense of optimistic caution. Many things have gone right to create the current economic expansion that has resulted in a low unemployment economy. America continues to innovate and it punches above its weight for worldwide brands. Although it has been the longest expansion ever in American History at over a decade, it can certainly continue. Look at Australia, which had an expansion for over two decades. However, underneath the surface there are items that provide caution.

Central banks around the world have continued their long term Quantitative Easing (“QE”) and push rates lower, to negative in many countries. This is not good news for commercial banks and other financial institutions that lend money. In the long run, banks need to have positive rates to generate profit. They make money on the net interest spread and that continues to be compressed. The constant QE and other monetary stimulus done by Central Banks are a danger to the world economy. Central banks trying to stave off recession are only creating a larger asset bubble. Eventually the piper is paid.

Negative yields over the long run are unsustainable. No investor wants to be paid negative interest rates for the use of their capital. This may happen for a period of time but I suspect governments that keep rates negative will experience a deflationary period that can create long term stagnation. Look at what happened with Japan for the past three decades. Germany’s Bund (Germany’s government bonds) just crept back to positive but it is still near historic lows. Some economists argue if there are a lack of alternatives, then people would accept this negative rate. This makes no sense. I do not agree there are no alternatives. Central banks can choose not to expand balance sheets for example. Federal governments can push for growth through fiscal policies. In my mind sound fiscal policy is the engine that drives sustainable long term economic growth. Monetary policies can alleviate strong term economic stalls but it is not the answer for a long term economic game plan for growth. For example look at Sears, no amount of financial engineering could save that company because its core business was fundamentally flawed. The core business is the fiscal policy. Fiscal policy is what creates a better engine for sustainable economic growth. Monetary policy is more like a sound dashboard and accessories that complement the core fiscal policy engine. Sound fiscal policies and monetary policies together dovetail to create proper incentives. Wrong incentives lead to bad behavior.

|

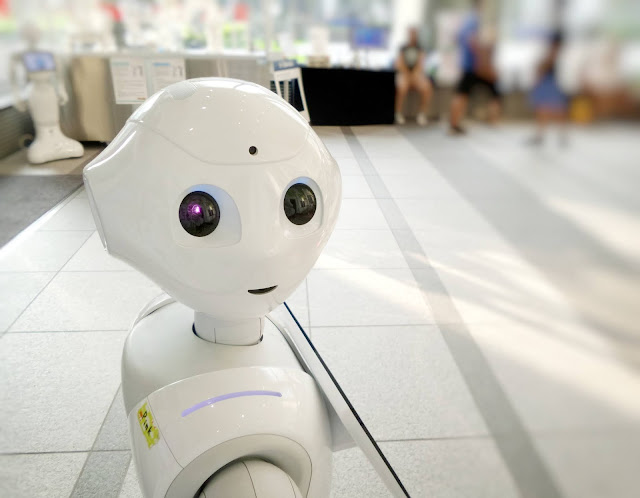

| Automation, artificial intelligence (“A.I.”), and robotics will decrease existing positions across all economic classes but it will hit middle income and lower income families the hardest. |

Unemployment has been low but many are still underemployed or not in the job they want. The American Middle Class continues to shrink. Automation, artificial intelligence (“A.I.”), and robotics will decrease existing positions across all economic classes but it will hit middle income and lower income families the hardest. For example, the biggest employer for American males without college degrees is the driving industry. This industry includes truck drivers, cab drivers, ride-hailing drivers, and bus drivers. Someday there will be A.I. driven vehicles that might take over most if not the whole industry. It may not happen in the next several years but it has a great chance to happen eventually.

We as a society needs to provide proper education for workers to find jobs in new industries that arise because of the advancement of technology. This is the inevitable loss of jobs for workers from old industries. It is a byproduct of human advancement accelerated by the power of capitalism. A great example is energy. Coal mines and coal plants continue to shut down and those jobs are not coming back. According to CNBC, there are approximately 52,000 coal miner jobs left in the U.S. as of 2019. This is a far cry from the 1923 peak of 863,000 coal miner positions. Renewable energy on the other hand employs over 855,000 people as of 2018 according to the International Renewable Energy Agency. Renewable energy includes solar, wind, and water energy sources. So Renewable Energy is a new industry that has created similar amounts of jobs. Granted, Renewable Energy employs a smaller proportion of the U.S. population than Coal Mining did in 1923 but it shows you the opportunities from disruptive new industries and the necessity for continuing education. As an added benefit, Renewable Energy is much more sustainable for Earth than coal.

History has proven when wealth dichotomy grows too big, civil unrest and populist anger ensues. It can be less violent such as the Gilded Age in the U.S. from 1870 to 1900, with large monopolies such as Standard Oil. This gave rise to Theodore Roosevelt who helped to break up these monopolies. Theodore Roosevelt, a Republican, was known as the “Trust Buster”. The more extreme version is a violent revolution such as the French Revolution from 1789 to 1799, which resulted in the downfall of the existing French Government and its leaders King Louis XVI and Queen Marie Antoinette. That royal family received the guillotine. This revolution also gave rise to Napoleon Bonaparte who took power in 1799. The consequence here was that Napoleon went on to affect the rest of Europe with his aim for conquest. Diverging wealth can also result in large political movements that spread to multiple countries. Examples include the Communist Movement in the early 1900s and the Arab Spring from 2010 to 2011.

Right now, there is a rise in populist anger not just in the West, but you see that in the inner regions of China as well. The anger is directed at current government institutions and establishment officials. We will see where this current unrest will lead in the near future. The rejection is happening on many levels. Lower income and middle income people have rejected traditional “business as usual” leadership in the West. Look at the rise of Donald Trump in the U.S., and Theresa May and Boris Johnson with the Brexit movement in the United Kingdom. Recent anti-immigration movements across Western countries are another sign of populism and frustration with the current system. If you think about it on a more profound second level is the rejection of international institutions created by the West. China has created their own version of the World Bank and the International Monetary Fund (“IMF”). Both China and Russia veto most resolutions in the U.N. Security Council. The rise of the “BRICS” block is a symbol of the developing world forming their own organizations in an attempt to shift the balance of world power. BRICS is an acronym for Brazil, Russia, India, China, and South Africa. The leaders of each of these 5 countries meet annually to the exclusion of the West. It is like a counterweight to the older western group called the “G7”.

Continued low unemployment has a real chance of overheating the economy and pushing up wages and inflation. If that happens, the Federal Reserve will have to combat that with higher rates to keep inflation in check. The recent repo market hiccup in September 2019 can be a minor trembling that is a prelude to a larger economic earthquake. In a nutshell, the repo market provides overnight liquidity to the financial market and there was a shortage in liquidity. The Fed had to step in with emergency liquidity injections. The Fed injected $53 billion on September 17, 2019 into the repo market and it injected hundreds of billions more through November 2019. In other words, the Fed substituted for the entire interbank lender market. That is not a good sign for the stability of the financial markets. This has stemmed from the Federal Reserve’s new round of Quantitative Easing. The Federal Reserve claims it is not doing Quantitative Easing but they are increasing the Fed’s balance sheet which by definition is QE.

Federal Reserve and Central Banks Around The World:

Central Banks around the world are current enablers of risky behavior and bad actors with lower interest rates and QE. When there is no interest expense to pay, it is grounds for politicians to overspend. It is also reason for households and corporations to over borrow. It also elevates asset prices across all types of asset classes including stocks, bonds, real estate, and commodities such as gold.

If you give a mouse a cookie it will want a glass of milk. In this case, the Market wants a whole barrel of milk. The Federal Reserve should give a definitive stop to rate cuts. Every time the Federal Reserve lowers the fed fund interest rate by 25 basis points (0.25%), it makes the Market expects more in the future. The Fed really needs a slightly higher rate so it has cushion to lower in the future. It really needs to reverse Quantitative Easing and lower its balance sheet so it has room to buy up assets in the future as a safety net for the Market and the economy as a whole in a recession. I rather trade short term pain for the Fed’s long term ability to combat recessions.

The Federal Reserve faces pressure on four fronts. It is pressured by the current President of the United States to lower rates, by other central banks that have lowered rates, by a slowing world economy, and by the Stock Market.

The Federal Reserve is trying to prevent a recession by constant monetary stimulus. I strongly believe this is a dangerous course of action. All it does is to inflate an asset bubble so that the next recession will be even more severe. Economic cycles are a fact of life throughout human history. The cycles help flush out irrational exuberance and speculation.

Paul Volcker passed away earlier this month. I commend him for being the most independent minded Federal Reserve Chair that we ever had. Mr. Volcker served as the Fed Chair from 1979 to 1987. He was nominated by President Jimmy Carter, a Democrat, in 1979 for a four year term and renominated for a second four year term by Ronald Reagan, a Republican, in 1983. Mr. Volcker had the courage to raise rates to double digits to contain inflation. He led the Federal Reserve the way its founders intended it to, by having the Federal Reserve chart its own course independent of executive pressure and what is happening in the asset markets. The world has lost a true champion of the independence of Central Banks.

After Mr. Volcker’s term ended in 1987, the Federal Reserve has become a servant of the Market instead of maintaining independence. Worst yet, it has become influenced by the Executive Branch which means its independence has eroded. Look at last December when the current Federal Reserve Chairman Jerome Powell signaled the Fed would raise rates. Several weeks later Chairman Powell not only stopped raising rates but signaled the Fed would start easing and lowering rates. It was a complete and utter reversal after the stock market experienced a decline in December 2018 and President Trump criticized the Fed’s tightening decision. To me, this just showed that the Fed bowed to the pressure of the stock market decline and worse yet, it bowed to the demands of the current President. To be fair to the Fed, President Trump has been the most aggressive President to date to criticize and pressure the Fed into doing what he wants, which is to go negative on interest rates. President Trump even considered trying to get rid of the current Fed Chair Powell to find someone more accommodative. This is just dangerous behavior for a President as it undermines the independence of the Fed.

In the most recent months, the Fed is doing another round of Quantitative Easing on top of the previous rate cuts and QE rounds. Chairman Powell says it is not easing but you can put lipstick on a pig and it is still a pig. The Fed’s balance sheet has risen since this announcement and that is the definition of QE!

So what are the implications of all this?

It is that the Federal Reserve has very little left it can do once the U.S. Economy does cool and eventually experience a recession. Worst yet, the Federal Reserve is inflating assets, which makes any asset bubble far worse than in the past. Recessions are a way of life and they are often helpful for the long run. Recessions helps to cool an overheating economy and reset asset bubbles. Now, interest rates are so low where can they go? If the Fed goes negative on rates, it would be cataclysmic to banks in the U.S. and for financial institutions around the world. There will be nowhere left for giant pensions and other governments to invest their cash. Many other countries have negative interest rates for quite some time including Japan, Spain, and Germany. My point is that if the Fed and the President keep trying to forever prevent a recession, that can create a much bigger bubble because it encourages even more speculation.

One other concern with this past year’s stock market growth is that it has all been PE multiple expansion driven by the Federal Reserve’s easy interest rate policy and the deficit spending from the Trump tax cut. This is in contrast to earnings expansion from corporations earlier in the current economic expansion. The average stock in the S&P was at approximately 15x PE in December 2018 and now it is over 24x average in December 2019. Plus, the amount of growth in the U.S. debt balance has grown by approximately the same size as the value of the Stock Market in the past twelve months. In other words, the entire GDP growth and stock market growth have been driven by the growth of the Federal Debt and easy monetary policy. This created an environment for assets to be bid up so PE ratios have grown faster than earnings growth. That is not sustainable!

In 2020 and the coming years, Companies need to show earnings growth for this rally to continue. Note that 2019 saw an earnings recessions in a variety of industries. In other words not only did the numerator for PE go up in price, earnings went down in the denominator. There is certainly a chance that earnings growth can happen due to two factors. The American economy has shown strength. The Federal Reserve will not likely rock the boat in the run up to the Presidential Election. President Trump will have all the incentive in the world to pump up the Stock Market in his bid for reelection. The reason I say the point is that President Trump has made the rise in the Stock Market one of the barometers for how well he does as a President.

Another reason the rally will continue is that PE multiple expansion will continue. Although it is unlikely, the Market still has a ways to go to get to historic highs. Therefore it can certainly happen where the S&P pushes towards a 30x PE multiple and beyond. From a fiscal policy standpoint, the Fed will probably try to not move that much heading into a Presidential Election unless it is forced to do so. However, from a fiscal policy standpoint, President Trump and the Republicans will want to do everything they can to keep the current expansion growing to win reelection for the Presidency and to try and win both houses of Congress. Regardless of all these macroeconomic conditions, I invest for the long run so I am focused on an individual company basis. We evaluate investments on a microeconomic level.

The Fallacy Of Quantitative Easing:

In case I am not clear, let me state Quantitative Easing does not work in the long run. You may get a boost in the short run but history has proven otherwise. The other problem with monetary stimulus is that you need greater and greater amounts for it to work. In other words, it is similar to the effects of an addictive drug. QE did not work in saving Japan from a multigenerational deflation and economic stagnation. Japan kept their interest rates near zero for a long time and it did not work. The yen has never recovered to the level it stood at over 30 years ago. The Japanese economy is still stagnant and has not recovered in over three decades.

Europe is now on its own path of long term Quantitative Easing with low interest rates to negative rates. For example, Spain and Germany both had negative interest rates for a while. The German Bund interest rate recently became positive but it is still really low by historical standards. China continues to grow through a mountain of debt and constant monetary stimulus. The U.S. must not fall into the trap of perpetual QE. Financial engineering does not prevent recessions and cause long term problems. Although recessions are unpopular, they often act like a fever to help shake an illness.

Elimination of the Uptick Rule in 2007:

A watershed event that is little known to the public is the elimination of the Uptick Rule in 2007. The Uptick Rule was a trading restriction that short selling is only allowed on an increase in a security or the last traded price when the most recent movement between traded prices was upward, also known as an “uptick”. This gave rise to Quantitative Funds that buys strength and sells weakness. History has shown that great investors buy weakness instead, you want to be aggressive when others are fearful and vice versa. This elimination has created a much larger exaggeration of Market movement. It has created a future risk.

Corporate Bond Market:

There is too much corporate debt in the U.S. debt markets. Corporations have borrowed so much due to lower interest rates created by the Federal Reserve. As I have discussed in the past, it is better to invest in equities for the long run than in debt investments. Debt limits your upside and it does not take much to crush the investment if interest rates rise. In addition, the constant pressure to lower interest rates from the current President and the lack of covenants has created added risk to corporate debt investments. Covenants are protections written into the terms of a loan for creditors in the event of a default. Debt caps your upside while the downside is not as protected as many investors believe. The lack of debt covenants means debt investors will have little power to enforce any remediation with a company if it underperforms or goes into bankruptcy. Furthermore, interest rates are so low, the returns just do not match the level of risk. If you find a strong company, it is better to own its equity than its debt in the long run.

Government Deficits and Debt:

Too much leverage and debt is dangerous for individuals and corporations. Many regular people understand that concept. However, many in Congress and in the Executive Branch in the last three decades do not seem to know or seem to care about this concept. President Trump has made it clear he wants a lower dollar, negative interest rates, lower taxes, and wants the stock market to go up. The recent tax cut has ballooned U.S. federal debt levels.

How did we get here?

This started with the Reagan Administration’s trickledown economics which is to lower taxes for corporations and wealthy households, which in theory should “trickle down” to middle and lower classes of income households. This created enormous deficits and a quick rise in debt that was never seen in the prior 150+ years of the U.S. It was continued by subsequent Republican Administrations including the current one. Democratic Administrations have also added on to the deficit and national debt by pushing social programs including in the Obama Administration, although not as much. It is worth noting that during the Clinton Administration, the Federal Government ran at a budget surplus in his second term. Right now, we are pushing further in debt as a country which should be a cause for concern in the long run if it keeps up.

China and The Trade Deal:

The Trade War initiated by President Trump is just one element of the relationship with China. The U.S. and China are intertwined and competing on many fronts. On a trade level this relationship has natural synergies. China has an excess of labor and an economy growing up in manufacturing so it has excess capacity. The U.S. is a more mature economy focused on services and the culture lends itself to spending so it has high purchasing power for goods. On the flip side, the U.S. has a services surplus with China albeit not enough to cover the goods deficit.

The U.S. wants better intellectual property protection. This is on two levels. First, it is the intellectual property (“IP”) theft from cyber attacks. Second, it is on the forced transfer of technology and other intellectual property because foreign companies, with a few exceptions, have to form a joint venture to do business in China. Lastly, the prolific fake copies of products have been a big concern. To be fair, China has been clamping down on copycats because there are now large companies there with intellectual property that are pushing for IP protection as well. However, it is often like the carnival “whack a mole” game, when one is shut down another one others pop up somewhere else. China is also pushing for better IP protection because their economy too is becoming more services oriented.

On a grander scale, the U.S. and China are competing to be the leader in economics and influence in the world. The root cause stems from geopolitics. I love studying history because it rhymes most of the time and explains countries’ behaviors. China was an ally of the U.S. and the other Allied Countries in both World War I and World War II. Since then it adopted a Communist ideology which competed against the U.S. and the rest of the West’s capitalist and democratic ideology. Geographically and politically, China feels the U.S. has surrounded the Chinese coast. On a political level, the U.N. is mostly funded by the U.S. and is headquartered in New York. The IMF and World Bank are located in the West and mostly funded by the U.S. as well.

Geographically, China feels the U.S. surrounds it by the sea and this concept has validity. Look at the Chinese coast starting from the north and going south. One of our largest army bases is in South Korea near the border of North Korea which in turn is just a few hundred miles from China’s capital of Beijing. Contuining south down the coast, our only forward deployed fleet, the 7th Fleet, is in Okinawa, Japan, and it is the largest fleet we have. We sell billions of dollars worth of military weapons to Taiwan over the past several decades. The U.S. has had training camps in the Philippines until Philippines President Duterte ended the 65 year military alliance with the U.S. We had our huge airbase that holds bombers at Guam. We are reestablishing relationships and trying to strengthen it with Vietnam. So we do have a ring around China by the sea.

This has led China to establish its Belt and Road Initiative to counteract this potential cutoff of the seas in the event of a conflict. According to the World Bank, the Belt and Road Initiative is expected to cost over $1.32 trillion, approximately $745 billion from China and approximately $575 billion from 70 participating other countries. This has created business opportunities there. Contrary to popular belief, it is not just the land road of the ancient Silk Road. Yes there are train lines and roads being built from the coast of China all the way to Duisburg, Germany (the world’s largest inland port), but the Belt and Road Initiative is also a sea route linking Southeast Asia, Sri Lanka, Pakistan, and all the way to Basrah, Iraq in the Persian Gulf. The sea route also forks through the Suez Canal and connects by land to Duisberg from the Southwest. The land route also forks through Pakistan all the way to the Indian Ocean to connect with the sea route. China also has been building their man-made islands in the South China Sea. Other countries such as Vietnam and the Philippines also have their claims and have built man-made installations. None are on the scale of China’s. There are abundant amounts of oceanic resources such as untapped oil, fish, and other potential assets. This makes sense for China to push these areas because of not just political reasons but also from a business perspective as well. Politics and business are often intertwined and they often can drive each other.

Tying It All Together:

Although there are a lot that can worry investors, I strongly believe we are well positioned should a downturn comes. We own the stocks of #1 niche leading companies that we are confident will perform well for investors in the long run. What happens in the next several months is anybody’s guess. That is not our game. Our game is to invest for the long run. If we abandon our investments every time the Market appears overvalued, we eliminate our chance for long term compounding returns.

We play defense in the current market environment by being cautious with new investments. We continue to find sound companies that are reasonably priced. Furthermore, we currently favor companies that have been able to whether recessions. We are watching what we consider as great companies and we will strike when the valuation makes sense. This can mean we invest into new companies or add on to existing companies. We will invest regardless of macroeconomics or the overall Stock Market.

Talguard’s Strategy and Objective:

Talguard Value Fund LP is a private investment fund that seeks to preserve and grow wealth by investing in the equities of companies with durable competitive advantages purchased at reasonable prices. The goal is to survive the one year that no one else does. In this process, we also aim to beat the Barclay Hedge Fund Index over the long run as that is a large worldwide survey of our competitors.

I am looking for a very specific type of company for investment. These companies are often #1 in their niches, have many years of consistent and growing cash flow, and certain other attributes. Most importantly, these companies often have multiyear catalysts that will generate value over time. Once identified, I will seek a discount to intrinsic value prior to investing. However, I rather invest in great companies at fair valuations instead of fair companies at great valuations. What I seek are often multiyear compounders.

Our portfolio consists of two groups of investments. The first group I call “Core Companies” that will often stay in our portfolio for the long run. These are great companies that I invest in either at discounts or at reasonable valuations. Core Companies have long term catalysts that can often span a decade or longer. For these Core Companies, holdings can be lowered when valuations are too high and they can be added on when prices take a dip.

The second group of investments that we hold is what I call “Opportunity Companies”. The Market usually has discounted these companies heavily either because of a short term weak earnings quarter or several quarters, an idiosyncratic sector selloff, or other very specific reason. I like to invest with a discount to intrinsic value here but I am also patient. Patience can result in Opportunity Company stocks providing a larger discount to intrinsic value.

As an emerging fund, we have a distinct advantage over large funds. We can be nimble while they often have to follow esoteric rules. Just because a well known fund is larger does not mean it performs better. In fact, a variety of studies have shown that emerging funds have often outperformed these larger funds. The most significant example is a comprehensive study produced by Nick Motson, Andrew Clare, and Dirk Nitzche, three finance professors at the City University of London. They surveyed 7,261 funds for 20 years from January 1995 to December 2014. They found that the largest 10% of funds returned an average of 7.32% a year for a total of 410.8% return over those 20 years. The smallest 10% of funds returned an average of 9.00% a year for a total of 560.4%. A $1 million investment in the largest funds category results in a balance of $4.1 million while the same investment in the smallest funds category results in a balance of $5.6 million. Of course, past performance is no guarantee of future results but the historical evidence is there.

A number of high profile large funds not only continue to underperform the Market over multiple years, but they have negative returns while the Market has enjoyed a near decade bull run. Larger funds do not necessarily translate to better results.

On a separate note, my strategy has an advantage that many emerging funds do not possess. Talguard has invested primarily in large cap and mid cap companies which means our strategy is highly scalable. Many emerging funds are focused on small cap and micro cap companies. These emerging funds cannot take on too much more capital for their strategy investing in the same small cap companies because the float on those shares is much smaller. These emerging funds would alter the Market for shares of these small cap companies which means prices can go down significantly when they sell or up when they buy. In other words, micro cap stocks are more prone to big price movements from the buys and sells of a large buyer as compared with larger companies. Talguard has the advantage here because many of our investments have sufficient volume and liquidity when we buy or sell.

Summary:

I view each investable dollar as a soldier standing patiently on top of a mountain looking at the field. My soldiers comprise a patient army waiting for the right opportunity. When the opportunity comes, my army of investable dollars will attack.

At Talguard, we are dedicated to a powerful craft, and we run on long term principles. I view owning stock as being a co-owner of the underlying business in that security.

Our expertise in the U.S. and China in particular has provided investors with a way to invest in two of the leading markets in the world. And yes, the current trade war does not damper these opportunities in the long run. Remember, some of these companies have benefited from the current disputes as well and some companies we invest in are not as dependent on trade between the two countries.

We know there are opportunities out there. We know we can find them.

I guard and grow your wealth over the long run. Compounding returns over long periods of time is one of the most powerful forces in the Universe. I want to fully take advantage of compounding returns and the best way to achieve that is to find quality companies who are #1 in their niches with long term cash flow prospects and invest at a reasonable price.

I am looking for a very specific type of company for investment. These companies are often #1 in their niches, have many years of consistent and growing cash flow, and certain other attributes. Most importantly, these companies often have multiyear catalysts that will generate value over time. Once identified, I will seek a discount to intrinsic value prior to investing. However, I rather invest in great companies at fair valuations instead of fair companies at great valuations. What I seek are often multiyear compounders.

Our portfolio consists of two groups of investments. The first group I call “Core Companies” that will often stay in our portfolio for the long run. These are great companies that I invest in either at discounts or at reasonable valuations. Core Companies have long term catalysts that can often span a decade or longer. For these Core Companies, holdings can be lowered when valuations are too high and they can be added on when prices take a dip.

The second group of investments that we hold is what I call “Opportunity Companies”. The Market usually has discounted these companies heavily either because of a short term weak earnings quarter or several quarters, an idiosyncratic sector selloff, or other very specific reason. I like to invest with a discount to intrinsic value here but I am also patient. Patience can result in Opportunity Company stocks providing a larger discount to intrinsic value.

As an emerging fund, we have a distinct advantage over large funds. We can be nimble while they often have to follow esoteric rules. Just because a well known fund is larger does not mean it performs better. In fact, a variety of studies have shown that emerging funds have often outperformed these larger funds. The most significant example is a comprehensive study produced by Nick Motson, Andrew Clare, and Dirk Nitzche, three finance professors at the City University of London. They surveyed 7,261 funds for 20 years from January 1995 to December 2014. They found that the largest 10% of funds returned an average of 7.32% a year for a total of 410.8% return over those 20 years. The smallest 10% of funds returned an average of 9.00% a year for a total of 560.4%. A $1 million investment in the largest funds category results in a balance of $4.1 million while the same investment in the smallest funds category results in a balance of $5.6 million. Of course, past performance is no guarantee of future results but the historical evidence is there.

A number of high profile large funds not only continue to underperform the Market over multiple years, but they have negative returns while the Market has enjoyed a near decade bull run. Larger funds do not necessarily translate to better results.

On a separate note, my strategy has an advantage that many emerging funds do not possess. Talguard has invested primarily in large cap and mid cap companies which means our strategy is highly scalable. Many emerging funds are focused on small cap and micro cap companies. These emerging funds cannot take on too much more capital for their strategy investing in the same small cap companies because the float on those shares is much smaller. These emerging funds would alter the Market for shares of these small cap companies which means prices can go down significantly when they sell or up when they buy. In other words, micro cap stocks are more prone to big price movements from the buys and sells of a large buyer as compared with larger companies. Talguard has the advantage here because many of our investments have sufficient volume and liquidity when we buy or sell.

Summary:

I view each investable dollar as a soldier standing patiently on top of a mountain looking at the field. My soldiers comprise a patient army waiting for the right opportunity. When the opportunity comes, my army of investable dollars will attack.

At Talguard, we are dedicated to a powerful craft, and we run on long term principles. I view owning stock as being a co-owner of the underlying business in that security.

Our expertise in the U.S. and China in particular has provided investors with a way to invest in two of the leading markets in the world. And yes, the current trade war does not damper these opportunities in the long run. Remember, some of these companies have benefited from the current disputes as well and some companies we invest in are not as dependent on trade between the two countries.

We know there are opportunities out there. We know we can find them.

I guard and grow your wealth over the long run. Compounding returns over long periods of time is one of the most powerful forces in the Universe. I want to fully take advantage of compounding returns and the best way to achieve that is to find quality companies who are #1 in their niches with long term cash flow prospects and invest at a reasonable price.

For potential investors contact us today at investors@talguard.com.

Best,

Dan H. Chen

President

Talguard Investments LLC

Dan H. Chen is the Founder and CEO of Talguard Investments LLC. He has a passion for equity investments and founded Talguard because he saw an opportunity to provide investors a concentrated long term equity solution based on his own unique experience and circle of competence. Dan has over 18 years of experience and is focused on seeking equity investments that generate compounding returns over the long run. Dan has a rich set of experience in both the “Buy Side” and “Sell Side” of the finance industry. He has experience investing in a wide variety of industries. He has direct experience in the equity, debt, and real estate asset classes. Because of his wide experience, he has seen why equities have proven to be the most successful asset class. Dan is a “Quality Investor”. He looks to invest in the equities of businesses that have certain attractive qualities such as being the leader in their niches and long term positive cash flow.

Prior to founding Talguard, Dan was an Investment Analyst in the portfolio management team at Ares Management. He was responsible for the evaluation and investment of Companies in business services, informational technology, real estate, industrial products, and consumer products. His team was directly responsible for over $10 billion of investments at the time. Ares Management is a private investment company that currently has over $100 billion of assets under management that invests in equities, real estate, bank debt, high yield bonds, and term loans.

Prior to Ares, Dan was an Assistant Vice President at Trinity Capital where he successfully led negotiations between multiple stakeholders in a variety of restaurant companies including the private equity buyout and restructuring of Burger King Corporation. Trinity Capital LLC is a restructuring company focused on the restaurant and real estate industries.

Prior to Trinity, Dan was an Investment Banking Analyst at Bear, Stearns & Co. Inc. where he was responsible for directly working with CEOs and CFOs, creating financial models and presentations and brainstorming ideas in advising the management teams of Fortune 500 companies. Dan was involved in the successful completion of 11 transactions totaling over $3 billion that included IPOs, secondary offerings, mergers, acquisitions, divestitures, and hostile takeover defense. Industries covered included Financial Services, Consumer Products, Consumer Services, Technology, Insurance, Health Care, Media, and Entertainment.

Dan has co-authored a book called “The Secrets Of Chinese Wisdom” with Amy C. Lee to teach people how Chinese sayings and wisdom from the past several thousand years have relevance to success in the modern world.

Dan’s favorite activity is to read. He reads broadly in non-fiction, company filings, business news, and business autobiographies. Dan believes that mentors can be alive or dead as their words live on through their written thoughts. One can learn so much from reading. Dan is a lifetime member of Friends of the El Segundo Library. He helped fund the development of the new area of the library where patrons can study and enjoy interactive activities. He hopes libraries will continue to provide a vital role in the expansion of knowledge for humankind even in the face of digitization.

Dan is a member of the Young Physicians & Professional Alliance of Torrance Memorial Hospital (“YPPA”). He believes in the cutting edge facilities and the staff that provides quality healthcare at affordable prices to the surrounding communities. Dan has donated to fund the development of Torrance Memorial’s Pediatric/Young Adult Pavilion launched in 2018. Dan is a big believer in science and its role in the future of humanity. He supports the Griffith Observatory and has been a Friend of the Observatory.

Dan has recently received accreditation from Harvard University with an EDX certification. Dan received an MBA from the Anderson School of Business at UCLA as part of the fully employed program while at Ares Management. He received a Bachelors of Science in Business Administration from the Haas School of Business at the University of California at Berkeley. While attending U.C. Berkeley, Dan studied abroad at the prestigious Tsinghua University in Beijing and Beijing Normal University, graduating top of class.

Disclaimer Statement:

This document and information herein represents the views of Talguard Investments LLC and is not to be considered investment advice. The information herein should not be considered a recommendation to purchase or sell any particular security or financial instrument. There can be no assurance that any securities discussed herein will remain in the Talguard Value Fund LP.

This document does not constitute an offer to sell or a solicitation to buy membership interests in the Talguard Value Fund LP. Past performance is not necessarily indicative of future results. All information provided herein is for informational purposes only.

Investment in the Fund will involve significant risks due to, among other things, the nature of the Fund’s Investments (as defined herein). Investment in the Fund is suitable only for sophisticated investors and requires the financial ability and willingness to accept the high risks in an investment in the Fund. No assurance can be given that the Fund’s investment objectives will be achieved or that investors will receive a return of their capital.

In making an investment decision, prospective investors must rely on their own examination of the Fund and the terms of this offering, including the merits and risks involved. Prospective investors should not construe the contents of this letter as legal, tax, investment or accounting advice. Prospective investors are urged to consult with their own advisors with respect to legal, tax, regulatory, financial and accounting consequences of their investment in the Fund.

©2019 Talguard Investments LLC, all rights reserved.