To my investors, I want you to know that one of my main missions in life is to prove to those who believed in me and in our team at Talguard that they were right. The Markets are experiencing significant volatility and the defense I have been playing for months is working to our benefit. I expect continued volatility in the coming months so we will continue to play defense until the time is right to go on the offensive.

COVID-19 and Rational Thought:

The recent virus outbreak that originated in Wuhan, China, dubbed the “Corona Virus”, and officially COVID-19, has dominated world headlines for months. It rattled Chinese stock markets first and those markets have bounced back in a certain degree. Whether there will be a pullback again remains to be seen. The infection rate has slowed in China due to their drastic measures of implementing a mass quarantine of an entire province. What is bizarre is that the initial quarantine had a four day warning period which meant over 5 million people were able to escape the quarantine zone prior to the borders closing for the Hubei Province. Nevertheless, the drastic measures instituted in China including construction of 11 temporary hospitals in a week appeared to have an effect in slowing down the spread of COVID-19 within China.

The contagion has now spread to dozens of countries with hotspots in Japan, South Korea, Italy, and Iran. COVID-19 cases have developed in all continents except Antarctica. It has spread to the United States and I surmise the number infected will rise as more tests are done and milder cases are identified. I wish our government in the U.S. including the Trump Administration and the CDC would push for more testing sooner. We need more testing kits and other measures to identify who has the virus to better contain its spread.

The Korean Journal of Radiology stated CT Scan images can be an effective way to identify COVID-19 and is more accurate than X-ray images. In addition, COVID-19 appears to be “radiologically milder” than both SARS (Severe Acute Respiratory Syndrome) and MERS (Middle East Respiratory Syndrome). It is an alternative to the testing kits now which appear to not have the highest accuracy rates. We need to be doing more to test who has the COVID-19.

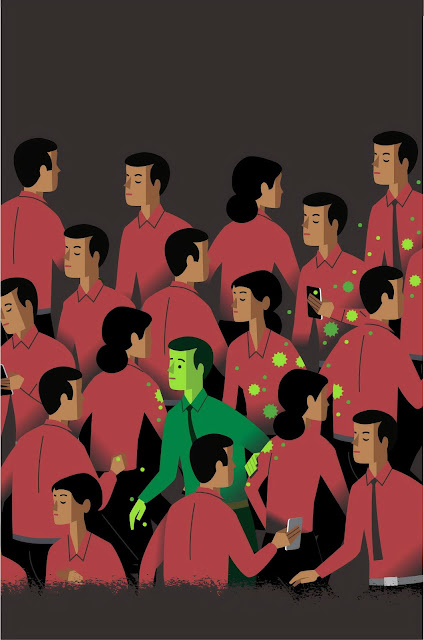

Part of the problem of what has spread so much fear is the incubation period of COVID-19. A person infected may not exhibit symptoms for up to 14 days. Compare that with common flu strains which usually produces symptoms within four days of contracting it. That is why it bewilders me how the U.S. and many other countries that have cases are not testing more. People are out there who may have it and do not know it and that is pushing the spread of the virus.

|

| Image provided by United Nations COVID-19 Response. People are out there who may have it and do not know it and that is pushing the spread of the virus. |

According to Worldometers.com as of March 8, 2020, there are currently over 110,000 people have the virus and over 3,800 deaths worldwide and both are expected to rise. Over 62,200 have recovered thus far. Of the active known cases, approximately 38,000 are mild (86%) and approximately 6,000 are serious (14%). The death rate has been the lowest in South Korea because they have been testing at a rate of over 10,000 a day. The U.S. and other countries really needs to step up testing across the country. Although more testing kits are being sent in the coming weeks, I find that Western governments have dropped the ball here. We should follow the lead of China, Japan, and especially South Korea when it comes to testing.

It has caused stress on global supply chains and reduced travel in a significant way. Economic activity, especially social activity and leisure activity have and will slow down if not grind to halt. Cruises, flights, hotels, and amusement park stays are postponed or canceled. Box office revenues for theaters in China and Italy have been reduced by approximately 85% and 75%, respectively, for the first two months of 2020.

In theory, warming weather as we head into the spring and summer should help reduce the outbreak but there is no guarantee. I do not think the panic and fear will subside until you see a worldwide slow down of the infection rate similar to what you are seeing in China.

The Federal Reserve and Interest Rates:

While it should cushion a more drastic drop in asset values, it is a disappointment that the Federal Reserve (the “Fed”) capitulated to the Market again. The Fed instituted an emergency 50 basis point rate cut which brings us back down to 1.00%. There is now a good chance the Fed will reduce rates again in their scheduled meeting on March 16th and 17th, 2020. The interest rate reduction does nothing to get people to take more plane rides or go out to a restaurant when there is concern about infection and death. Furthermore, Treasury rates are heading close to zero and we are dangerously close to negative.

On the positive side, I highly commend Chairman Jerome Powell who has held the line against going to negative rates against both the Trump Administration and some of his predecessors. As I discussed many times, negative rates will significantly damage the global financial system and it will be fatal to some banks and other financial companies. Many central banks around the world have gone negative with their rates. The U.S. is one of the few large economies left offering positive interest rates. If we go negative on rates, there will be no where for many pension funds and other large capital pools to invest in for government securities.

Most importantly, near zero and negative interest rates for an extended period have not worked. Look at Japan, their economy have been stagnate for over 30 years with zero and negative rates. Negative rates suppress economic growth and have created stagnation. Plus prolonged low rates and central banks such as the Fed always riding to the rescue creates bubble-like conditions for investments.

One of the worst long term investments in the world is buying 10 year treasuries with a current yield, also known as interest rates, of less than 1.0% as it has dropped as low as 0.66%. You are locking in your money for 1.0% or less for 10 years which means you are almost certain to lose to inflation. Plus if interest rates go up your principal will go down. 30 Year Treasuries are also going below 1.00% interest rates. Over the course of 30 years or more, I much rather own the stocks of great businesses rather than owning government debt at these low rates.

Economy:

I am quite optimistic about the prospects of the American economy for the long run. I am also optimistic about China’s economy for the long run. The two economies are deeply intertwined and the world’s prospects will depend much on this relationship. However, there is a high degree of probability that COVID-19 will adversely affect world GDP growth in the near future.

Whether the slowdown is for a quarter or for a longer period remains to be seen. If it is at least two quarters of slowdown then you have a recession. Regardless of the COVID-19 virus, valuations were stretched anyways and other events could have led to a pull back in valuations. The virus can be worst than a slowdown in business activity or economic trade tensions because it is affecting people’s health and mental psyche with the possibility of death of themselves or loved ones and that often creates a more extreme reaction and pullback in activity.

COVID-19 will adversely affect what I call the “experience industries”, which are businesses that rely on movement of people and goods for business or leisure activities. Most public gathering places are getting hurt financially in the near term as well. Oil and petroleum related industries have already saw oil prices slide even before the Corona Virus situation started.

However, now that Russia is pulling out of the OPEC+ alliance in order to try and bankrupt American shale companies, Saudi Arabia is pumping out more oil to maintain market share. These recent events have created a historic collapse in oil prices. This will lower input costs but it will not do much for these industries if demand decreases due to contagion fear. I tend to shy away from oil and other commodity businesses in addition to avoiding capital intensive, cyclical businesses such as cruise ships and airlines so we have not been hurt by the shock to these industries.

Not all industries will suffer a slow down with the current outbreak. Some industries will actually benefit from the current fear. I am keeping a watchful eye on them.

What’s Next:

A worldwide coordinated fiscal response is needed to stem the hit to the world economy. This means country leaders, executive branches, and legislative branches need to step up and provide legislation for stimulus in order to instill confidence to a panicked public across the world. This is because monetary policy is not going to do it for a major health scare. Monetary policy is more akin to pushing on a string at this point. Governments are starting to get that message.

The U.S. Government’s $8.3 billion package announced last week is too little and does nothing to instill economic confidence. China’s $170 billion liquidity injection in early February 2020 along with its national mobilization of resources helped bounced their market back and the infection rate has dropped to the point the Chinese Government is about to lift the quarantine and shut down its 11 temporary hospitals. Even then that might not be enough as it takes time for the engines of supply chains and manufacturing to get back to full capacity and make up for lost production. Even if supply returns to normal you need demand to be there to purchase that. We will see how the consumer and demand fairs in the coming months. That will be the biggest indicator if we head for a recession.

We will continue to play defense in the coming months. The market had a big run up last year and some valuations are stretched. I have no idea what will happen in the next several days or several months. I do know that we will do well in the long run if purchased at a reasonable price. I view our investments as part ownership of great businesses. And those businesses will most likely grow shareholder wealth over the long run.

Summary:

I view each investable dollar as a soldier standing patiently on top of a mountain looking at the field. My soldiers comprise a patient army waiting for the right opportunity. When the opportunity comes, my army of investable dollars will strike.

At Talguard, we are dedicated to a powerful craft, and we run on long term principles. I view owning stock as being a co-owner of the underlying business in that security.

Our expertise in the U.S. and China in particular has provided investors with a way to invest in two of the leading markets in the world. And yes, the current COVID-19, corporate debt concerns, and trade wars do not damper these opportunities in the long run. Remember, some of these companies have benefited from the current environment as well as a byproduct of our defensive stance.

We know there are opportunities out there. We know we can find them.

I guard and grow your wealth over the long run. Compounding returns over long periods of time is one of the most powerful forces in the Universe. I want to fully take advantage of compounding returns and the best way to achieve that is to find quality companies who are #1 in their niches with long term cash flow prospects and invest at a reasonable price.

For potential investors contact us today at investors@talguard.com.

Best,

Dan H. Chen

President

Talguard Investments LLC

Dan H. Chen is the Founder and CEO of Talguard Investments LLC. He has a passion for equity investments and founded Talguard because he saw an opportunity to provide investors a concentrated long term equity solution based on his own unique experience and circle of competence. Dan has over 18 years of experience and is focused on seeking equity investments that generate compounding returns over the long run. Dan has a rich set of experience in both the “Buy Side” and “Sell Side” of the finance industry. He has experience investing in a wide variety of industries. He has direct experience in the equity, debt, and real estate asset classes. Because of his wide experience, he has seen why equities have proven to be the most successful asset class. Dan is a “Quality Investor”. He looks to invest in the equities of businesses that have certain attractive qualities such as being the leader in their niches and long term positive cash flow.

Prior to founding Talguard, Dan was an Investment Analyst in the portfolio management team at Ares Management. He was responsible for the evaluation and investment of Companies in business services, informational technology, real estate, industrial products, and consumer products. His team was directly responsible for over $10 billion of investments at the time. Ares Management is a private investment company that currently has over $100 billion of assets under management that invests in equities, real estate, bank debt, high yield bonds, and term loans.

Prior to Ares, Dan was an Assistant Vice President at Trinity Capital where he successfully led negotiations between multiple stakeholders in a variety of restaurant companies including the private equity buyout and restructuring of Burger King Corporation. Trinity Capital LLC is a restructuring company focused on the restaurant and real estate industries.

Prior to Trinity, Dan was an Investment Banking Analyst at Bear, Stearns & Co. Inc. where he was responsible for directly working with CEOs and CFOs, creating financial models and presentations and brainstorming ideas in advising the management teams of Fortune 500 companies. Dan was involved in the successful completion of 11 transactions totaling over $3 billion that included IPOs, secondary offerings, mergers, acquisitions, divestitures, and hostile takeover defense. Industries covered included Financial Services, Consumer Products, Consumer Services, Technology, Insurance, Health Care, Media, and Entertainment.

Dan has co-authored a book called “The Secrets Of Chinese Wisdom” with Amy C. Lee to teach people how Chinese sayings and wisdom from the past several thousand years have relevance to success in the modern world.

Dan’s favorite activity is to read. He reads broadly in non-fiction, company filings, business news, and business autobiographies. Dan believes that mentors can be alive or dead as their words live on through their written thoughts. One can learn so much from reading. Dan is a lifetime member of Friends of the El Segundo Library. He helped fund the development of the new area of the library where patrons can study and enjoy interactive activities. He hopes libraries will continue to provide a vital role in the expansion of knowledge for humankind even in the face of digitization.

Dan is a member of the Young Physicians & Professional Alliance of Torrance Memorial Hospital (“YPPA”). He believes in the cutting edge facilities and the staff that provides quality healthcare at affordable prices to the surrounding communities. Dan has donated to fund the development of Torrance Memorial’s Pediatric/Young Adult Pavilion launched in 2018. Dan is a big believer in science and its role in the future of humanity. He supports the Griffith Observatory and has been a Friend of the Observatory.

Dan has recently received accreditation from Harvard University with an EDX certification. Dan received an MBA from the Anderson School of Business at UCLA as part of the fully employed program while at Ares Management. He received a Bachelors of Science in Business Administration from the Haas School of Business at the University of California at Berkeley. While attending U.C. Berkeley, Dan studied abroad at the prestigious Tsinghua University in Beijing and Beijing Normal University, graduating top of class.

Disclaimer Statement:

This document and information herein represents the views of Talguard Investments LLC and is not to be considered investment advice. The information herein should not be considered a recommendation to purchase or sell any particular security or financial instrument. There can be no assurance that any securities discussed herein will remain in the Talguard Value Fund LP.

This document does not constitute an offer to sell or a solicitation to buy membership interests in the Talguard Value Fund LP. Past performance is not necessarily indicative of future results. All information provided herein is for informational purposes only.

Investment in the Fund will involve significant risks due to, among other things, the nature of the Fund’s Investments (as defined herein). Investment in the Fund is suitable only for sophisticated investors and requires the financial ability and willingness to accept the high risks in an investment in the Fund. No assurance can be given that the Fund’s investment objectives will be achieved or that investors will receive a return of their capital.

In making an investment decision, prospective investors must rely on their own examination of the Fund and the terms of this offering, including the merits and risks involved. Prospective investors should not construe the contents of this letter as legal, tax, investment or accounting advice. Prospective investors are urged to consult with their own advisors with respect to legal, tax, regulatory, financial and accounting consequences of their investment in the Fund.

©2020 Talguard Investments LLC, all rights reserved.